Intellectual Finance

Asset AllocationBusiness Development Company

The 90% Rule: Why BDCs are Legally Obligated to Make You Rich

Editors PickMutual Fund Performance

The Incubation Trick: How Funds Secretly Create 10 Funds Just to Market the One That Got Lucky

Behavioral FinanceEditors Pick

Why Your Brain Treats a $100 Bill and $100 of Bitcoin Like Two Different Currencies

Editors PickInternational Finance

The Real Cost of a Trade Surplus (and Why No One Will Admit It)

Editors PickInvestments

The Math of Recovery: Why a 50% Loss Needs a 100% Gain

Editors PickMust Read

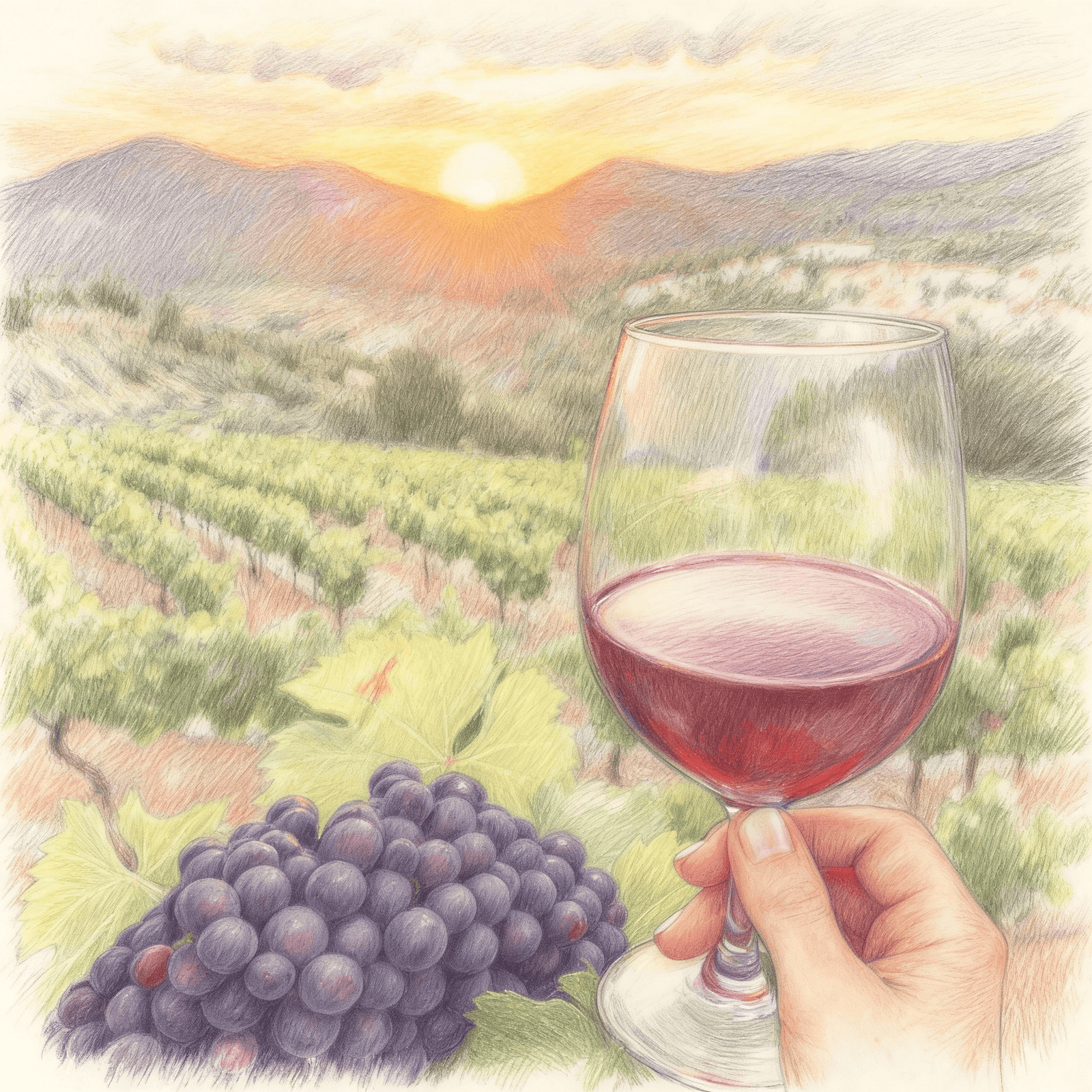

Bordeaux vs. Bitcoin: The Unlikely Investment That Doesn’t Crash on a Tuesday

Subscribe To Our Newsletter

Just one click away from Finance topics wrapped in intellectual layer!

Investing

Why a “Strong Economy” Can Actually Be Bad News for Your Portfolio

Intellectual Finance Team February 12, 2026

Everyone loves good economic news. Rising GDP, falling unemployment, consumer spending through the roof. Politicians celebrate it, financial commentators cheer ...

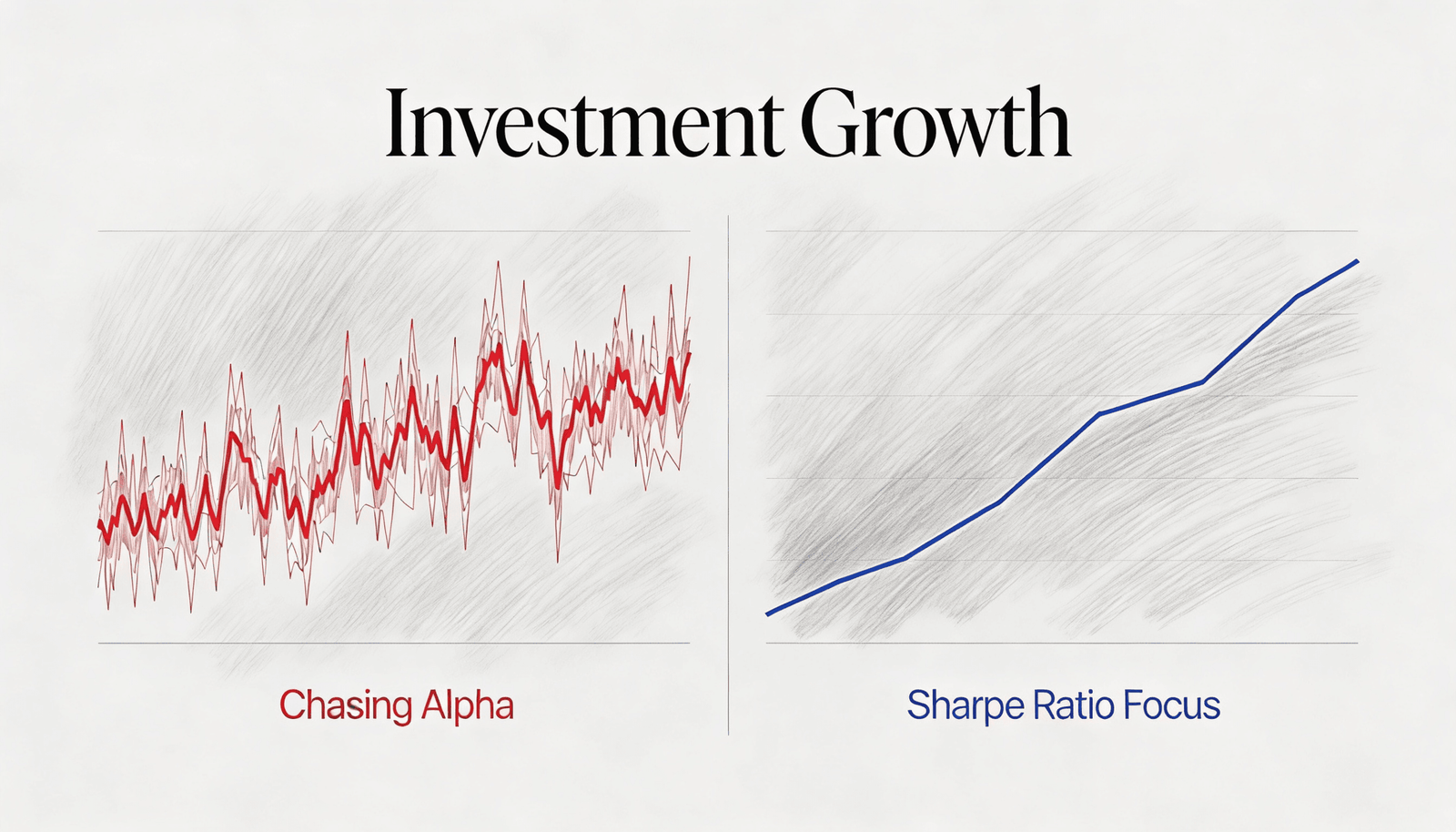

The Case for Stop Chasing Alpha: Why the Sharpe Ratio is the Only Metric That Matters

Intellectual Finance Team February 9, 2026

Many investors are playing the wrong game. They obsess over returns like kids comparing Halloween candy hauls, bragging about how ...

How to Build a Portfolio Immune to Noise (5 Steps to Escaping the Financial Herd Mentality)

Intellectual Finance Team January 5, 2026

The financial markets have a peculiar way of making intelligent people feel stupid and reckless people feel like geniuses. At ...

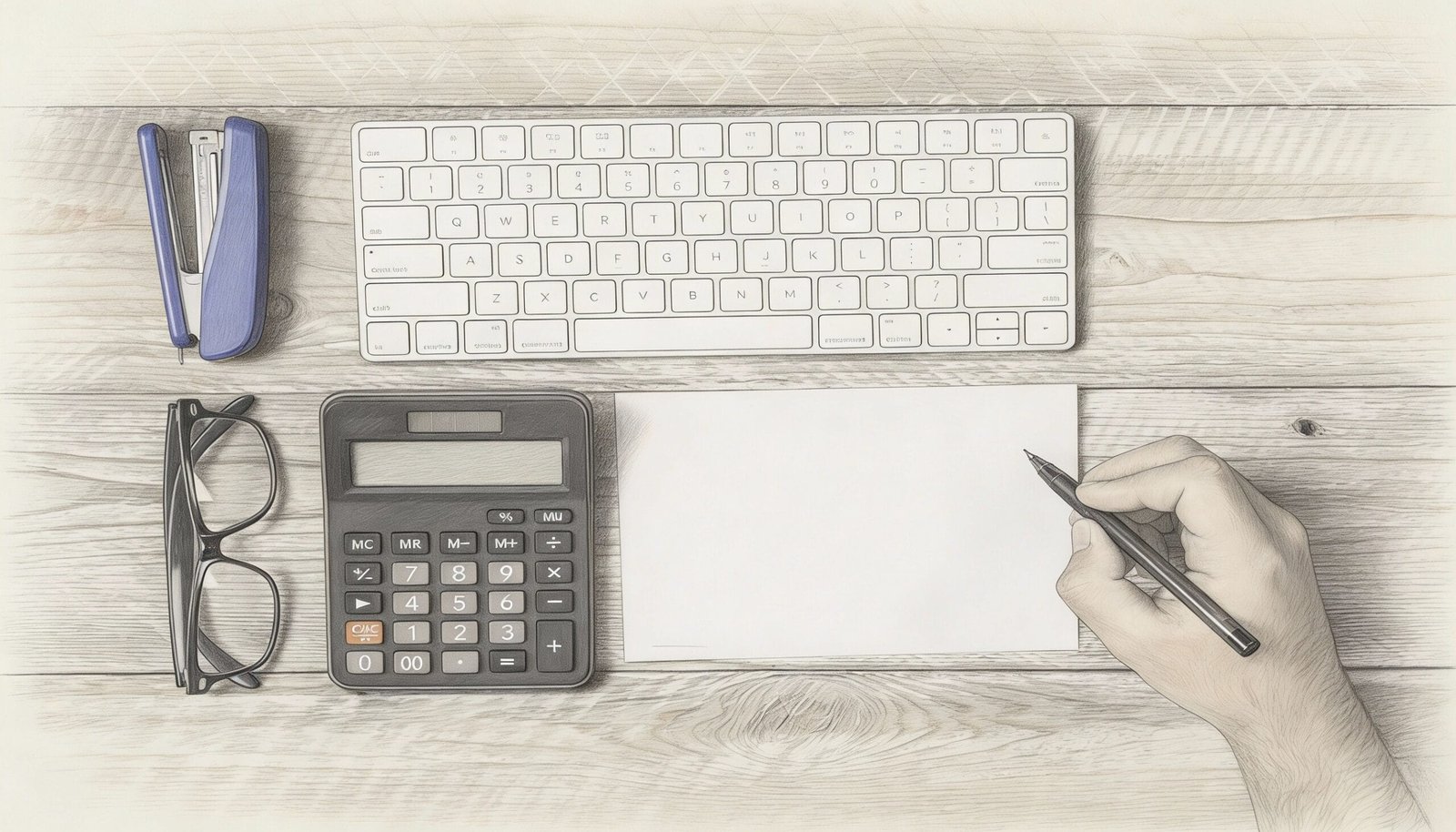

If You Can’t Calculate NAV, You Shouldn’t Be Investing in Funds

Intellectual Finance Team January 4, 2026

Net Asset Value is absurdly simple to calculate. You take what a fund owns, subtract what it owes, and divide ...

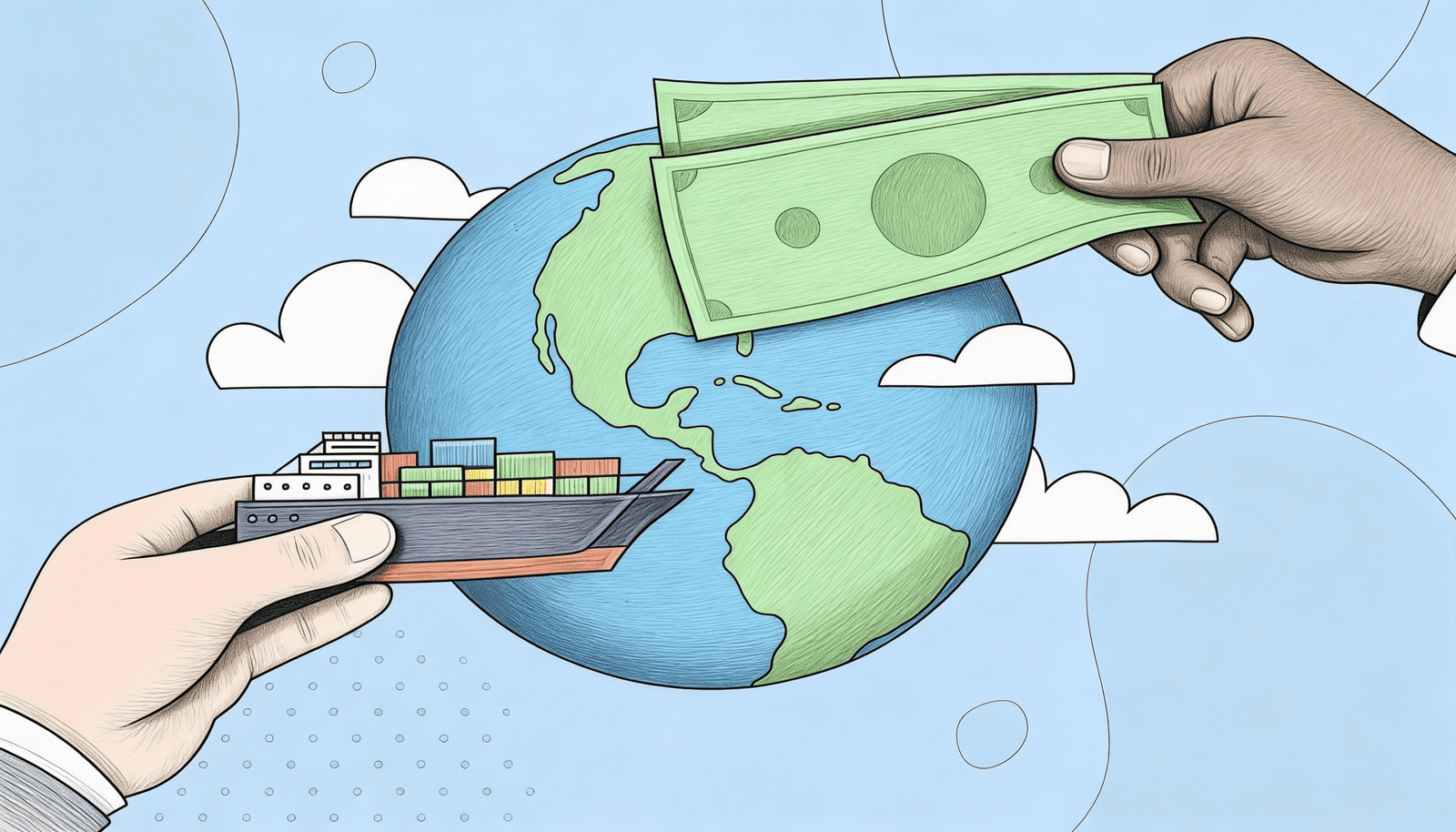

International Finance

The Real Cost of a Trade Surplus (and Why No One Will Admit It)

Intellectual Finance Team December 24, 2025

Every country wants to be a winner. And in the grand theater of international economics, nothing signals victory quite like ...

Funding Currency Hierarchy: Why JPY and CHF Are Not Interchangeable for Carry Trade

Intellectual Finance Team December 16, 2025

The financial world loves to categorize. We sort currencies into buckets labeled “safe haven” or “high yield” as if they ...

Is the Bank of Japan Actually the World’s Biggest Hedge Fund?

Intellectual Finance Team December 15, 2025

Picture a central bank. You probably imagine something austere. Gray suited officials poring over inflation data. Sober discussions about interest ...

Financial Subcultures

From $0 to Financial Freedom in 7 Years: The Unconventional Roadmap in FIRE Movement

Intellectual Finance Team December 13, 2025The FIRE movement promises something most financial advice doesn’t dare to: actual freedom in exchange for actual sacrifice. Not the …

Behavioral Finance

Dopamine vs. Dividends: The Neurological Reason You Can’t Stop Day Trading

Intellectual Finance Team February 13, 2026Your brain doesn’t care about your retirement account. It cares about what happened in the last three seconds. This fundamental …

Emoji Economics: Can a Rocket Ship Icon Actually Predict a Rally?

Intellectual Finance Team February 10, 2026

We live in an age where a picture of an eggplant can mean something other than ...

The Availability Heuristic: Why One Bad News Story Outweighs Ten Years of Growth

Intellectual Finance Team February 10, 2026

Your brain is a terrible financial advisor. Not because it lacks intelligence or processing power, but ...

Must Read

Editors PickMust Read

Bordeaux vs. Bitcoin: The Unlikely Investment That Doesn’t Crash on a Tuesday

There’s something profoundly absurd about comparing a bottle of fermented grapes to a string of mathematical code. Yet here we ...

Intellectual Finance Team

December 8, 2025

Behavioral FinanceEditors Pick

Forget FOMO: The Real Danger Is Loving Your Stocks Too Much

Everyone talks about FOMO. The fear of missing out supposedly drives investors to make stupid decisions, chasing returns they see ...

Intellectual Finance Team

December 5, 2025

Editors PickFinancial Economics

The Bitcoin Problem: Where Does Crypto Fit into a Modern Portfolio Theory Strategy?

Harry Markowitz won a Nobel Prize in 1990 for work he published in 1952. That work, Modern Portfolio Theory, changed ...

Intellectual Finance Team

December 4, 2025