Table of Contents

You probably think the internet is free. You open your laptop, connect to WiFi, and suddenly have access to the entire world. No toll booths. No admission fees. Just pure, democratic access to information and entertainment.

Except someone owns every inch of it.

Every email you send travels through cables owned by someone. Every video you stream passes through servers owned by someone. Every cell tower your phone pings belongs to someone. And that someone collects rent. They always collect rent.

The question is whether you want to be the tenant or the landlord.

The Invisible Empire

The internet feels like air. Invisible, everywhere, essential. But air is actually free. The internet is more like the electrical grid or the water system. It exists because someone built it, maintains it, and charges for access. The difference is that with electricity, you see the bill every month. With the internet, the rent collection happens in ways you barely notice.

Your internet service provider takes a direct cut. But that’s just the surface. The companies that own the fiber optic cables under the ocean, the data centers humming in Iowa, the cell towers disguised as trees—they all extract their share. Every click, every download, every stream generates a tiny payment that flows upward to the infrastructure owners.

This is not a complaint. This is an observation about how the world works. And more importantly, about how you can position yourself in this system.

Rent Seeking Gets a Bad Name

Economists use “rent seeking” as an insult. It describes the practice of extracting value without creating it. The landlord who raises rent but never fixes the leaky roof. The monopolist who charges more simply because they can.

But here’s what they miss: all stable wealth involves some form of rent. Dividends are just rent by another name. You own a piece of something valuable, and that something valuable generates income, and some of that income flows to you. The wheat farmer pays rent to the landowner. The software company pays rent to the landlord of their office building. And everyone with an internet connection pays rent to the infrastructure owners.

The moral judgment about rent seeking usually depends on whether you’re paying it or collecting it.

Internet infrastructure is particularly beautiful from an investment perspective because the rent is mandatory. You can choose not to eat at expensive restaurants. You can choose not to buy luxury cars. But try choosing not to use the internet. For most people in developed economies, that choice disappeared about fifteen years ago. Your job requires it. Your social life requires it. Your ability to function in modern society requires it.

The infrastructure owners don’t need to convince anyone to use their products. They just need to exist.

The Paradox of Utility

The most essential things in life tend to make the worst stories but the best investments.

Nobody writes epic novels about water utilities. No movies celebrate the heroes who maintain sewage systems. These businesses are boring. They’re also incredibly stable. People need water when the economy is booming. People need water when the economy is collapsing. The demand barely changes.

Internet infrastructure has reached this same level of necessity, but most people still think about it like it’s a luxury. They remember when having internet was optional, something you could do without. That world is gone. The internet is now infrastructure in the truest sense. It’s the foundation on which everything else is built.

This creates an interesting dynamic for dividend investors. The companies that own this infrastructure don’t need to innovate constantly. They don’t need to create the next viral app or breakthrough technology. They just need to maintain what exists and expand capacity as demand grows. It’s the investment equivalent of collecting highway tolls. The road doesn’t need to get fancier. It just needs to exist.

Different Layers, Different Rents

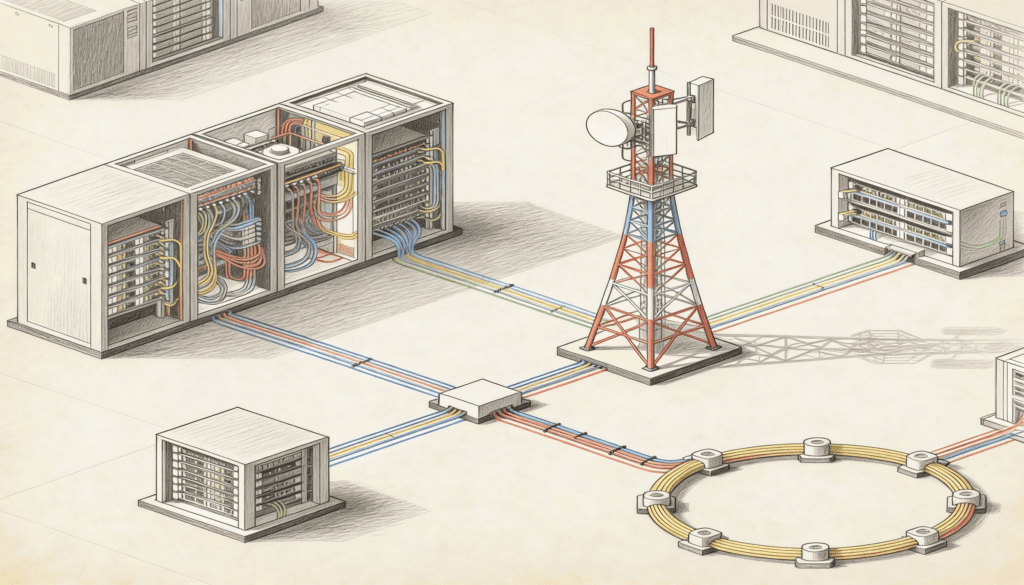

The internet isn’t one thing. It’s layers of infrastructure stacked on top of each other, and each layer has its own landlords.

At the bottom, you have the physical layer. Fiber optic cables. Cell towers. Data centers. Satellite networks. These are the most capital intensive to build but also the most durable. Once you lay an undersea cable from California to Japan, that cable works for decades. The companies that own these assets collect rent from everyone above them in the stack.

Then you have the network layer. Internet service providers. Telecom companies. These businesses don’t necessarily own all the physical infrastructure, but they control access to it. They’re like property managers. They don’t own the building, but they decide who gets in and what they pay.

Above that, you have the platform layer. Cloud computing services. Content delivery networks. These businesses rent the infrastructure below them and then rent it out again at a markup. They add convenience and reliability, which creates value, which justifies the spread.

The interesting thing about this stack is that you can invest at any level. Each has different risk and return characteristics. The physical layer is more stable but grows slower. The platform layer is less stable but can grow faster. Dividend investors typically focus on the lower layers because that’s where the rent is most reliable.

The Toll Booth Economy

There’s a reason Warren Buffett loves toll booths. You build it once, then collect small payments from everyone who passes through, forever. The bridge doesn’t care if the economy is good or bad. It doesn’t care about fashion or trends. It just sits there, and people pay to cross it.

Internet infrastructure works the same way, with one important difference: the traffic keeps increasing. More people get online every year. Those who are already online use more bandwidth every year. Video quality increases. Cloud storage expands. Virtual reality emerges. Each trend means more data flowing through the pipes, which means more rent for the pipe owners.

This is what makes infrastructure different from most businesses. A restaurant can only serve so many customers before it runs out of seats. A factory can only make so many widgets before it runs out of capacity. But data infrastructure scales beautifully. Once the cable is laid or the tower is built, the marginal cost of sending one more byte of data is nearly zero.

The companies that own this infrastructure don’t work harder when traffic doubles. They just collect more rent.

The Democratization Myth

The internet was supposed to democratize everything. Information would be free. Anyone could become a publisher. Geographic barriers would disappear. Power would flow from institutions to individuals.

Some of this happened. You can learn almost anything on YouTube. You can start a business from your bedroom. You can reach a global audience with a blog.

But the infrastructure itself became more concentrated, not less. A handful of companies own most of the cloud computing capacity. Three companies dominate cell towers in America. A few massive players control the undersea cables. The tools became cheaper and more accessible. The infrastructure became more centralized and more valuable.

This creates an irony that most people miss. The more democratized the internet becomes for users, the more valuable it becomes for infrastructure owners. Every new creator on YouTube increases the value of Google’s servers. Every new online business increases the value of Amazon’s cloud platform. Every new app increases the value of cell tower companies.

The users feel empowered. The infrastructure owners collect the rent.

Dividends as Unearned Income

There’s a social stigma around unearned income. The phrase itself sounds vaguely immoral. Income should be earned. You should work for your money. Passive income is somehow less legitimate than active income.

This is a bizarre attitude when you examine it. The whole point of building wealth is so that eventually, your money works for you instead of you working for your money. The farmer who plants an orchard isn’t earning income from those trees for the rest of his life—he earned it when he planted them. The person who buys dividend stocks isn’t doing nothing—they’re allocating capital to businesses that need it.

Infrastructure dividends are particularly pure because the business model is so simple. The company builds the infrastructure, maintains it, and collects payments from users. Revenue comes in. Costs go out. What’s left over gets distributed to shareholders. There’s no complicated story about future growth or market share or strategic pivots. The business already works. The question is just whether it will keep working.

For internet infrastructure, the answer is yes, because the infrastructure is now essential. People can’t choose to stop using it without dropping out of society.

This makes the dividends remarkably stable. Not exciting. Not explosive. Just stable. Which for many investors is exactly the point.

The Contrast with Creation

The companies that create content for the internet are nothing like the companies that own the infrastructure. Content companies live and die by hits. A movie studio needs blockbusters. A game company needs hits. A social media platform needs to stay cool. These businesses are exhausting. They’re constantly fighting for attention, constantly trying to predict what people will want next.

Infrastructure companies just sit there and collect tolls.

This doesn’t mean content companies are bad investments. Some of them do extremely well. But they require a different kind of analysis. You need to predict taste. You need to predict trends. You need to predict competition. With infrastructure, you just need to predict whether people will keep using the internet.

One is about art. The other is about physics. Art is subjective. Physics is reliable.

The irony is that the creative people, the ones making the content and building the apps and inventing new ways to use the internet, they’re the ones making the infrastructure valuable. They’re sharecroppers, essentially. They till the land and plant the crops, and the landowner takes a cut. This isn’t a moral judgment. It’s just how the system works.

Understanding this helps you decide where to put your money.

Inflation Protection Built In

Infrastructure has a peculiar relationship with inflation. When costs rise, infrastructure owners can usually pass them along. Internet service providers raise prices. Data centers increase fees. Cell tower companies adjust their rates. The customers complain but keep paying because they don’t have a choice.

This isn’t true for all businesses. A grocery store can’t easily pass along higher costs because customers will shop elsewhere. A manufacturer might absorb higher input costs to maintain market share. But infrastructure owners have pricing power because their product is essential and alternatives are limited.

For dividend investors, this matters enormously. Many dividend stocks suffer during inflation because their real returns erode. But infrastructure dividends tend to grow along with inflation, or at least not fall as far behind. The rent adjusts to reflect the cost of everything else.

This doesn’t make infrastructure a perfect inflation hedge. Nothing is perfect. But it’s better than most options.

The Boredom Factor

The biggest challenge with infrastructure investing is that it’s incredibly boring. Nothing exciting happens. The company announces another quarter of steady cash flow. The dividend gets paid. The stock price barely moves. And repeat.

For many investors, this is torture. They want excitement. They want stocks that double in a year. They want to tell stories at parties about their brilliant investments.

Infrastructure doesn’t provide this. It provides quiet, steady returns. It provides income that arrives like clockwork. It provides the financial equivalent of watching paint dry.

But here’s the thing: boring is good. Boring means predictable. Boring means stable. Boring means you can plan your life around the income without constantly worrying about whether the business will survive the next recession or technological shift.

The paradox is that pursuing excitement usually leads to stress, while accepting boredom usually leads to comfort. Most people know this intellectually. Few people act on it.

The Ownership Mindset

Buying shares in infrastructure companies requires a mental shift. You’re not betting on growth. You’re not hoping for a buyout. You’re not timing the market. You’re buying a tiny piece of the system that everyone needs to use, and you’re collecting your proportional share of the rent.

This feels different from most investing. It’s less about speculation and more about positioning. You’re not trying to predict the future. You’re just trying to place yourself on the right side of an ongoing transaction.

Think of it like buying a house near a toll bridge. You don’t care who uses the bridge or why. You just know that property near essential infrastructure tends to hold value because the infrastructure creates steady economic activity. Internet infrastructure works the same way, except you can own it directly through stocks instead of buying property near it.

The Time Horizon Question

Infrastructure investing only makes sense with a long time horizon. If you need your money back in two years, buying infrastructure stocks for dividends is probably wrong. The dividend yield might be 3% or 4%, which isn’t enough to justify the risk over a short period.

But if you’re investing for ten years or twenty years or forever, infrastructure starts to look different. The dividends compound. The companies slowly increase payouts as revenue grows. The stability means you can reinvest without worrying about perfect timing. And the decades pass, and you collect rent, and your income slowly grows.

This requires patience that most investors don’t have. They want results now. They want to see their account balance increase dramatically. Infrastructure investing offers something else: the reasonable expectation that you’ll be collecting income from essential systems for as long as those systems exist.

Given that the internet isn’t going anywhere, that’s a fairly long time.

Buying dividend stocks in infrastructure companies won’t make you rich overnight. It won’t give you exciting stories to tell. It won’t feel like you’re doing anything particularly clever. But it will give you a small share of the rent that everyone else pays to use the internet. And that rent keeps coming, year after year, as long as people keep clicking and streaming and scrolling.

Which means essentially forever.