Table of Contents

When Isaac Newton watched an apple fall, he discovered gravity. When traders watch portfolios fall, they discover margin calls. The difference between these two discoveries is that gravity was inevitable, while portfolio losses are optional.

Most investors treat market crashes like weather events. They huddle inside, wait for the storm to pass, and hope their roof holds. But what if you could build a portfolio that doesn’t care about storms? Not because it’s invincible, but because it’s designed to hover above the chaos entirely.

This is the promise of market neutral strategy. While the name sounds like financial Switzerland, the strategy is less about neutrality and more about creating your own private economy that runs on different rules than everyone else’s.

The Magician’s Trick

Market neutral strategies work on a simple principle that most people find counterintuitive: you can make money when things go up and when things go down, sometimes at the same time. It’s like being able to bet on both teams in a football game and still coming out ahead.

The mechanics involve buying stocks you think will outperform while simultaneously shorting stocks you think will underperform. If you’re right about the relative performance, you profit regardless of whether the overall market climbs, crashes, or sleepwalks sideways.

Think of it like this. Imagine you own a bakery and an ice cream shop next door to each other. Summer comes, ice cream sales explode while bread sales stay flat. You profit from the difference even though you’re in both businesses. Now imagine winter arrives and the opposite happens. You still profit from the spread. The weather changed completely, but your business model didn’t care.

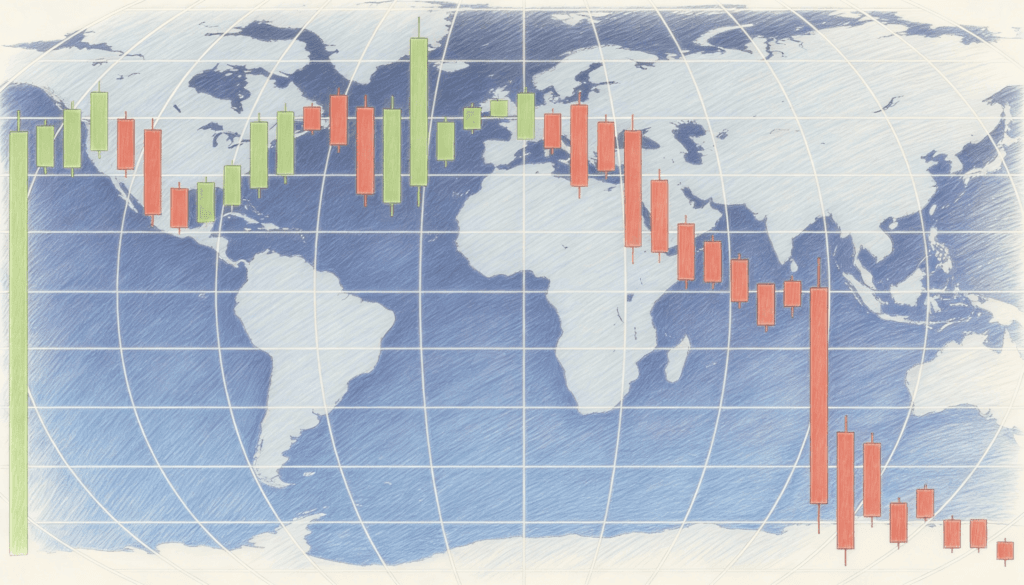

This is why market neutral strategies can show green returns while the S&P 500 bleeds red. They’re playing a different game entirely. The absolute direction of the market becomes background noise. What matters is relative performance, the gap between winners and losers.

Why Most People Don’t Discover This

There’s a psychological barrier that stops most investors from even considering market neutral approaches. It stems from how we’re taught to think about investing from childhood. Buy good companies. Hold them forever. The market goes up over time. These mantras get embedded so deeply that alternative approaches seem almost heretical.

It’s similar to how people used to believe you needed to own land to build wealth. For centuries, this was true. Then someone invented stocks, bonds, and eventually derivatives. Each innovation seemed bizarre and risky to the previous generation. Market neutral strategies are just the latest evolution in a long line of financial innovations that expand what’s possible.

The other barrier is emotional. Making money when markets crash feels vaguely immoral to some people. There’s a cultural script that says you should suffer alongside everyone else during downturns. Taking profits while your neighbors are losing their retirement savings can feel like dancing at a funeral. But this is confused thinking. You’re not causing the crash. You’re just refusing to be a victim of it.

The Engineering Behind the Illusion

At its core, market neutral trading is about constructing a portfolio that has minimal correlation to broad market movements. You achieve this by balancing long positions with short positions so that the two sides offset each other’s market exposure.

Let’s say you invest $100,000. You buy $100,000 worth of stocks you believe will outperform. Then you short $100,000 worth of stocks you believe will underperform. Your gross exposure is $200,000, but your net market exposure is close to zero. You’re now floating above the market’s gravitational pull.

When the market drops 30%, your long positions might drop 20% while your short positions drop 40%. The difference between losing 20% and gaining from a 40% drop on the short side puts you ahead. The actual numbers vary based on your stock selection, but the principle remains constant. You profit from being right about relative performance, not absolute direction.

This isn’t magic. It’s arithmetic. But arithmetic that most people never learn because traditional investing education focuses almost entirely on long only strategies.

The Hidden Costs of Conventional Wisdom

Long only investing carries a hidden assumption that most people never examine. It assumes the future will be better than the past. This has been true for American markets over long periods, but it’s a historical accident, not a law of nature. Japanese investors who bought the Nikkei at its 1989 peak waited over 30 years just to break even. European investors have faced similar challenges.

The conventional wisdom tells you to ride out downturns, but this advice only works if recoveries happen within your investment timeline. If you’re 60 years old when a crash hits, waiting a decade for recovery means you’re 70 before you’re whole again. That’s not patience. That’s gambling with time you don’t have.

Market neutral strategies sidestep this entire problem. They don’t require faith in inevitable recovery. They only require that some stocks outperform others, which happens in virtually every market environment. Even in crashes, some companies fall less than others. Even in crashes, some sectors hold up better. This variation is all the strategy needs to function.

The Paradox of Protection

Here’s where things get interesting. Market neutral strategies don’t protect you from losses. They protect you from market losses. There’s a crucial difference.

You can absolutely lose money in a market neutral strategy if you’re wrong about which stocks will outperform versus underperform. What you can’t do is lose money simply because the market decided to have a bad day, month, or year. Your returns disconnect from the market’s mood swings.

This creates a strange situation where you might underperform during raging bull markets while dramatically outperforming during crashes. It’s like wearing a raincoat. You look foolish carrying it around on sunny days, but you look brilliant when the storm hits.

Most investors can’t tolerate this dynamic. During bull markets, they watch their market neutral positions grow modestly while their neighbors brag about 40% returns. The temptation to abandon the strategy and chase returns becomes overwhelming. Then the crash comes, their neighbors lose everything, and they wish they’d stayed disciplined.

Connections to Other Domains

Market neutral trading shares surprising parallels with other fields. In medicine, vaccines work by exposing you to a controlled dose of a pathogen so you build immunity. Market neutral strategies expose you to controlled doses of both market directions simultaneously, building immunity to directional risk.

In physics, noise cancelling headphones work by generating sound waves that are opposite to ambient noise, creating silence through addition rather than subtraction. Market neutral portfolios generate opposing market exposures that cancel each other out, creating returns through differentiation rather than direction.

These parallels aren’t just intellectual curiosities. They reveal something fundamental about how complex systems manage risk. The answer is rarely to avoid exposure entirely. It’s to create offsetting exposures that neutralize systematic risk while preserving specific opportunities.

The Limits of Levitation

No strategy is perfect, and market neutral approaches have their own vulnerabilities. The most obvious is that you need to be right about relative performance. If you buy stocks that underperform and short stocks that outperform, you lose on both sides. The market might crash 30%, but you could still end up down 40% if your picks are backwards.

There’s also the challenge of shorting costs. When you short a stock, you have to borrow shares from someone else. This isn’t free. In volatile markets or with hard to borrow stocks, these costs can eat into returns significantly. It’s like trying to defy gravity while paying rent on your levitation device.

Liquidity is another consideration. In calm markets, moving in and out of positions is easy. During crashes, liquidity evaporates. The very moment you most want to adjust your portfolio is often when it’s most expensive or difficult to do so. It’s like discovering your parachute works great until you actually need it.

Perhaps the biggest limitation is psychological. Market neutral strategies often produce steady, unexciting returns. They’re designed to be boring. But humans crave excitement. We’re wired to chase big gains and feel like we’re winning. A strategy that methodically grinds out 8% to 12% annually while protecting downside feels unsatisfying compared to the lottery ticket appeal of finding the next Tesla or Apple.

Who This Actually Serves

Market neutral strategies aren’t for everyone. They work best for investors who value capital preservation over home run potential. People who need consistent returns regardless of market conditions. Retirees living off their portfolios. Institutions with liabilities they need to match. Anyone who can’t afford to ride out a lost decade.

They’re also ideal for investors who understand that missing the downside is more important than catching every upside. If you avoid a 50% crash, you only need 0% returns to outperform someone who lost half their money. The math of loss recovery is brutal. Lose 50%, and you need 100% gains just to break even. Market neutral strategies let you skip this entire nightmare.

But they’re terrible for young investors with decades ahead of them who can genuinely ride out crashes. They’re wrong for anyone chasing exponential wealth. And they’re frustrating for people who need to feel like they’re on the winning team during bull markets.

The Future of Not Caring

As markets become more efficient and correlations increase due to index fund domination, market neutral strategies face both challenges and opportunities. The challenge is that everything moving together makes it harder to find genuinely divergent opportunities. The opportunity is that when correlations break, the dislocations become more dramatic.

We’re also seeing democratization of these strategies. What once required hedge fund minimums and sophisticated infrastructure is now accessible through ETFs and managed accounts. This accessibility has pros and cons. More people can protect themselves, but more people also misunderstand what they’re buying and bail out at the wrong times.

Technology is changing the game too. Machine learning algorithms can identify relative value opportunities faster and more comprehensively than human traders ever could. But they also create new risks. When everyone’s algorithm spots the same opportunity simultaneously, the edge disappears instantly. It’s an arms race with diminishing returns.

The Practical Reality

Implementing a market neutral strategy isn’t as simple as picking some longs and some shorts. You need to consider sector exposure, factor exposure, position sizing, rebalancing frequency, and dozens of other variables. Do it wrong, and you end up with hidden directional bets that destroy your neutrality right when you need it most.

Most individual investors are better off accessing these strategies through funds managed by people who do this professionally. The DIY approach sounds appealing, but shorting stocks has unlimited loss potential if you’re wrong. It’s not like buying a stock where the worst case is losing what you invested. Short a stock and watch it triple, and you can lose three times your initial position.

There are also tax implications. Short term trading generates ordinary income tax rates rather than favorable capital gains treatment. The strategy has to work even harder to deliver after tax returns that justify the complexity and costs involved.

The Deeper Question

Market neutral trading forces you to confront a fundamental question about investing. Do you want to beat the market, or do you want to achieve your financial goals? These aren’t always the same thing.

Most investors define success as outperforming an index. But this is arbitrary. It’s like saying you succeeded at dinner because you ate more than the person next to you, regardless of whether you’re still hungry. Maybe the goal should be meeting your nutritional needs, not winning an eating contest.

If your goal is growing your wealth from $500,000 to $5 million as fast as possible, market neutral strategies probably aren’t your path. You need concentration and risk. But if your goal is protecting $5 million while generating enough income to live on, market neutral approaches might be exactly right. The strategy matches the objective.

This connects to a broader truth about finance that people resist. There’s no single best strategy. There are only strategies that match or don’t match your situation, timeline, and risk tolerance. Market neutral trading is one tool in a larger toolkit. Using it effectively means understanding when it’s appropriate and when it isn’t.

Final Thoughts

The anti-gravity strategy isn’t really about defying gravity. It’s about building a portfolio that operates on different physics than conventional investing. While others rise and fall with market tides, you float on relative performance.

This doesn’t make it superior to traditional investing in all circumstances. It makes it different. Sometimes different is exactly what you need. When the S&P 500 drops 30% and your portfolio stays green, you’ll feel vindicated. When the S&P 500 rises 50% and your portfolio creeps up 10%, you’ll feel foolish. The question is which scenario you’re preparing for and which one you can afford.

The beauty of market neutral strategies is they give you permission to stop worrying about things you can’t control. You can’t control whether the market crashes. You can control whether you’re exposed to that crash. This shift from passive hope to active design is empowering.

Most investors spend their careers as passengers, hoping the market drives them somewhere good. Market neutral traders become pilots, charting their own course regardless of prevailing winds. The destination might not be as exotic, but you actually reach it.

In the end, arriving somewhere predictable beats crashing on the way to somewhere exciting.