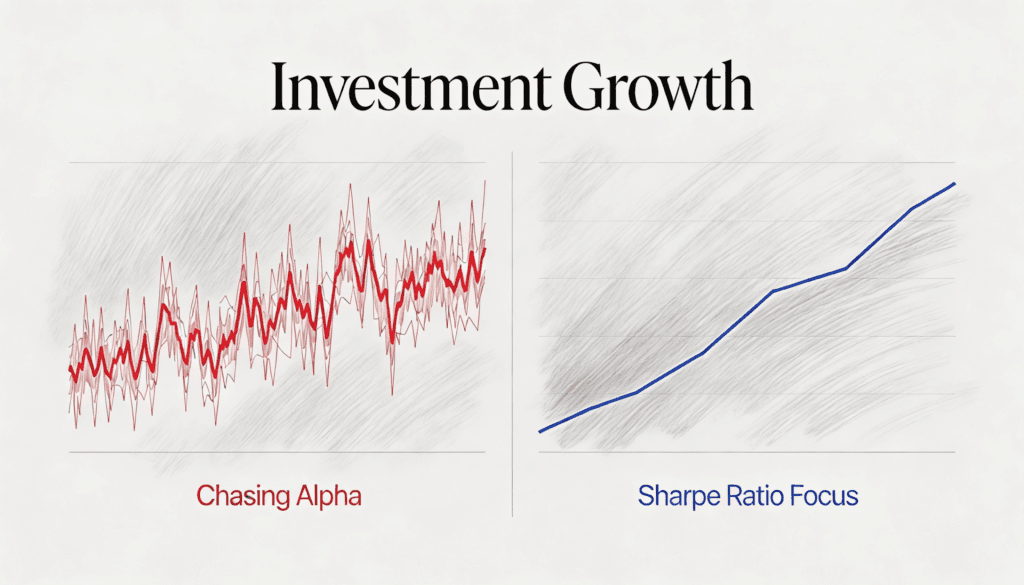

The Case for Stop Chasing Alpha: Why the Sharpe Ratio is the Only Metric That Matters

Many investors are playing the wrong game. They obsess over returns like kids comparing Halloween candy hauls, bragging about how much they got while conveniently forgetting to mention the stomach aches. The financial industry encourages this myopia because it sells products. Beat the market. Alpha generation. Outperformance. These phrases populate marketing materials like confetti at […]

The Case for Stop Chasing Alpha: Why the Sharpe Ratio is the Only Metric That Matters Read More »