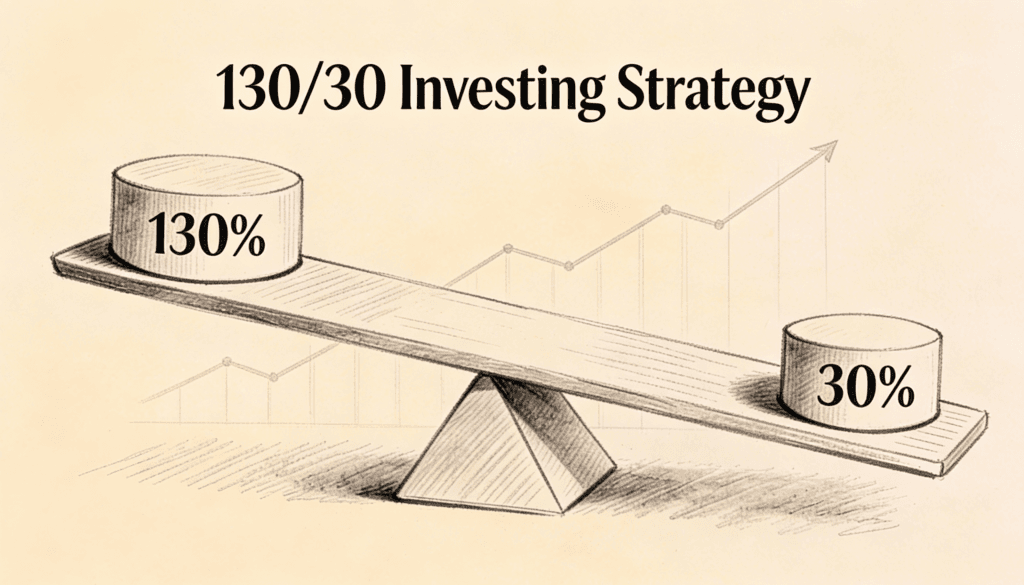

130/30 vs. Traditional Long-Only: Which Wins in a Bear Market?

There’s something almost rebellious about the 130/30 strategy. While the rest of the investment world spends centuries perfecting the art of picking winners, someone decided the real edge might come from simultaneously betting against losers. It’s a bit like a restaurant critic who doesn’t just recommend great restaurants but actively warns you away from bad […]

130/30 vs. Traditional Long-Only: Which Wins in a Bear Market? Read More »