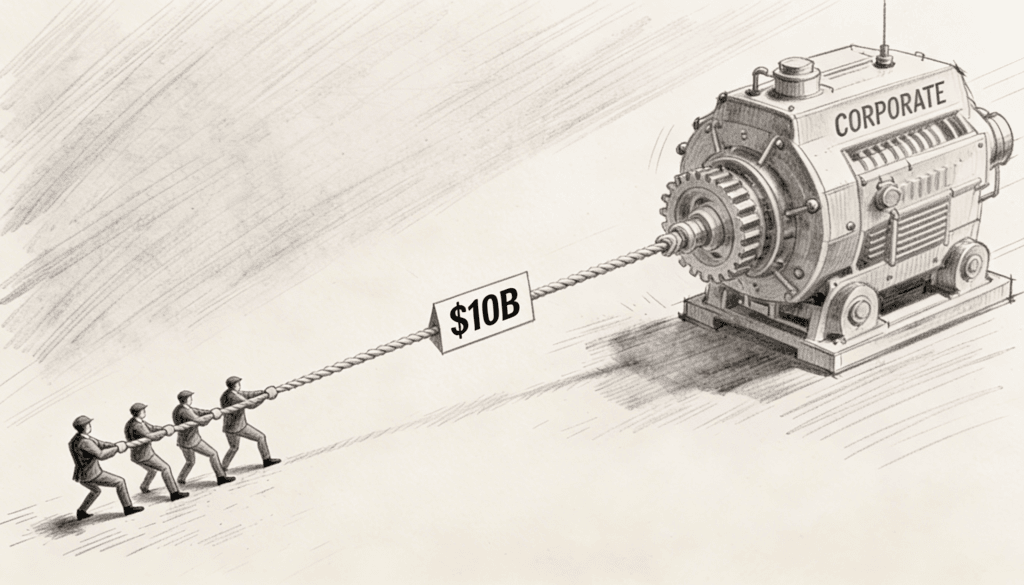

The Physics of Finance: Why Doubling a $10B Market Cap is 10x Harder Than a $1B

Most investors treat market capitalization like a number on a scoreboard. A company worth ten billion dollars is simply ten times bigger than one worth a billion. This arithmetic thinking makes intuitive sense until you actually try to double these companies and discover that the laws of finance behave more like the laws of physics […]

The Physics of Finance: Why Doubling a $10B Market Cap is 10x Harder Than a $1B Read More »