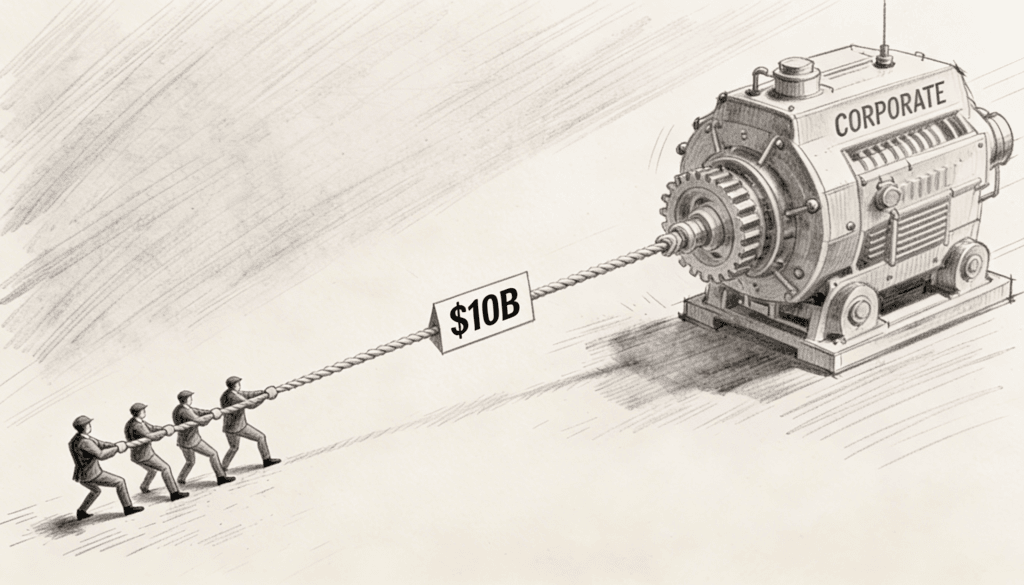

The Final Boss: What Happens to the Economy When a Company Hits $10 Trillion?

We’ve been here before, sort of. Remember when people thought a billion dollars was unfathomable wealth? Then we got used to billionaires. Then trillion dollar companies arrived and we shrugged. Now we’re staring at the possibility of a ten trillion dollar company, and the strange thing is how normal it already feels. But it shouldn’t […]

The Final Boss: What Happens to the Economy When a Company Hits $10 Trillion? Read More »