The Cult of the “Dip”: Why Buying Low is Psychologically Impossible for Most

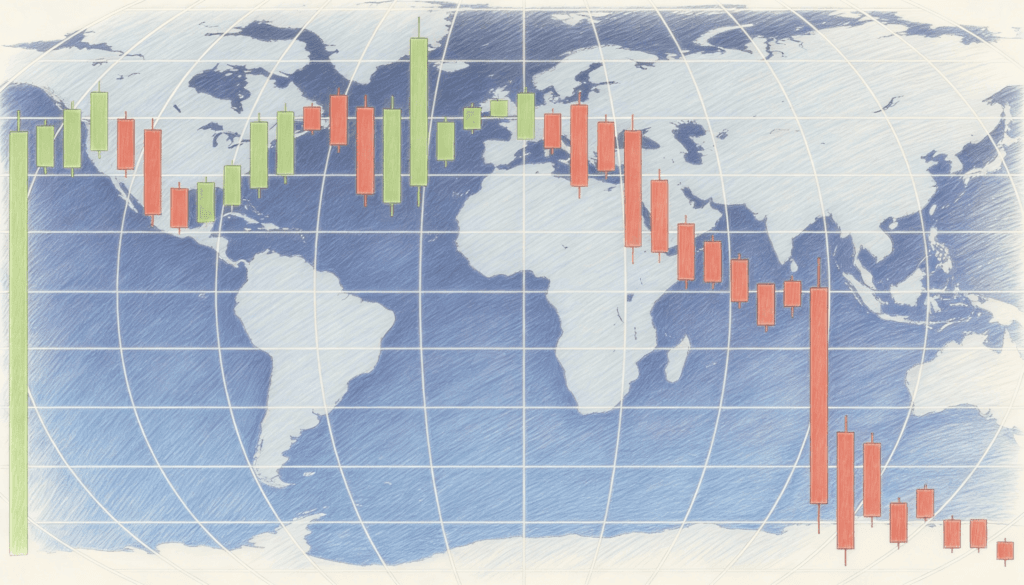

Everyone knows the secret to investment success. Buy low, sell high. It’s so simple that a child could understand it. Yet somehow, this basic principle has bankrupted more investors than any complex financial instrument ever could. The irony is almost perfect. The one thing everyone agrees on is the one thing almost nobody can do. […]

The Cult of the “Dip”: Why Buying Low is Psychologically Impossible for Most Read More »