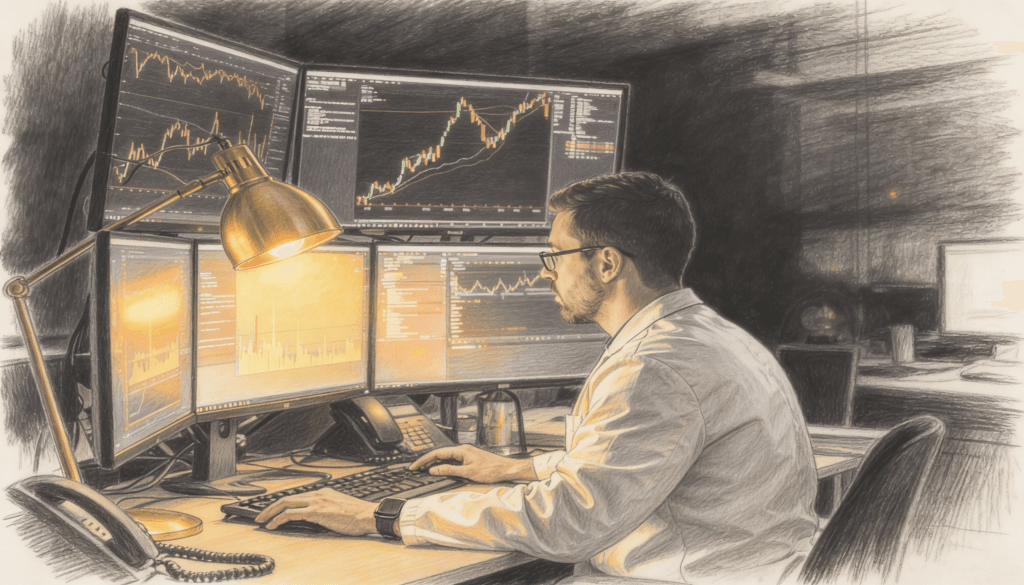

Why a “Strong Economy” Can Actually Be Bad News for Your Portfolio

Everyone loves good economic news. Rising GDP, falling unemployment, consumer spending through the roof. Politicians celebrate it, financial commentators cheer it, and your neighbor won’t stop talking about how great business is at his company. The economy is humming, and naturally, your portfolio should be soaring too. Except it doesn’t work that way. Here’s the […]

Why a “Strong Economy” Can Actually Be Bad News for Your Portfolio Read More »