Table of Contents

There’s a strange ritual in corporate finance where companies decide what to do with their profits. They can hand the cash directly to shareholders via dividends, or they can buy their own stock back from the market. One feels like getting paid. The other feels like a magic trick where your slice of the pie gets bigger without anyone actually giving you anything.

Most investors have a strong opinion about which is better. The dividend lovers want their quarterly checks. The buyback defenders pull out spreadsheets to prove their method is more tax efficient. But here’s what almost nobody talks about: both camps are probably wrong about why their preferred method actually works.

The Illusion of Getting Paid

When a company pays a dividend, something tangible happens. Money appears in your brokerage account. You can spend it, reinvest it, or just stare at it happily. The psychological satisfaction is real and immediate. It’s like your investment is a fruit tree that keeps producing.

But here’s the uncomfortable truth: that dividend didn’t make you richer. The moment the company pays out that cash, the stock price drops by roughly the same amount. It has to. The company literally has less money than it did before. You haven’t gained anything. You’ve just moved money from one pocket to another.

Think of it this way. You own a house worth half a million dollars. One day, you remove a brick worth a hundred dollars from the house and put it in your pocket. You now have a house worth $499,900 and a brick worth $100. Your net worth hasn’t changed. You’ve just rearranged your assets.

This is exactly what happens with dividends. The only difference is that the government shows up and taxes you on the brick.

Yet people love dividends. They love them so much that companies who pay regular dividends often trade at higher valuations than companies who don’t. The market is willing to pay extra for the privilege of receiving its own money back in a less efficient form. This isn’t entirely irrational, but the reasons why might surprise you.

The Buyback Mystery

Stock buybacks have the opposite problem. They’re supposed to be the smart, tax efficient way to return cash to shareholders. The company buys its own shares from the market and destroys them. With fewer shares outstanding, each remaining share represents a larger piece of the company. Your ownership percentage goes up without you doing anything.

On paper, this is beautiful. You don’t pay taxes until you decide to sell. The company is basically giving you a gift that the IRS can’t see yet. What could be better?

Except in practice, buybacks often fail to deliver what they promise. Studies show that companies tend to buy back stock when their share price is high, not low. This is the opposite of what a rational investor would do. Imagine walking into a store and only buying things when they’re marked up to maximum price. That’s what many corporations do with their own stock.

The reason is almost embarrassingly simple: executives feel good when the stock price is high. They want to keep the momentum going. They want to show confidence. They want to hit their bonus targets, which are often tied to earnings per share. And buybacks mechanically boost earnings per share by reducing the share count, even if they destroy value in the process.

So you have this curious situation where the supposedly sophisticated method often becomes a way for management to manipulate metrics and reward themselves, while the supposedly naive method actually enforces a kind of discipline.

What Dividends Actually Do

The real case for dividends has nothing to do with getting paid. It has everything to do with what dividends prevent.

A company that commits to a regular dividend can’t easily waste money. The cash goes out the door every quarter like clockwork. Management can’t use it to make a questionable acquisition. They can’t build a vanity project. They can’t let it pile up in the bank account where it slowly loses value to inflation and executive daydreams.

This is why dividend stocks often perform well over long periods. Not because the dividends themselves create value, but because the dividend policy stops value from being destroyed. It’s like having a financial supervisor for the management team.

There’s also something deeper going on with human psychology. When investors receive regular dividends, they’re less likely to panic and sell during market downturns. The cash flow provides comfort. It’s evidence that the company still works, that it still generates profits, that everything hasn’t disappeared into the ether. This stability in the shareholder base can actually help the stock price hold up better during tough times.

Older investors often prefer dividends for a different reason. When you’re retired, it’s psychologically easier to spend investment income than it is to sell shares. Selling shares feels like eating your seed corn. Taking a dividend feels like harvesting what was meant to be harvested. The math is identical, but the emotional experience is completely different. And since we’re not perfectly rational calculating machines, that emotional experience matters.

What Buybacks Actually Do

The best case for buybacks isn’t about tax efficiency. It’s about flexibility.

A company that pays dividends creates an expectation. Cut that dividend and the stock price will probably collapse. Investors who bought the stock for income will flee. The dividend becomes a trap. The company must keep paying it even if better uses for that cash emerge.

Buybacks have no such burden. The company can buy back stock this year, stop next year, and start again the year after. Nobody feels betrayed. There’s no broken promise. This flexibility is genuinely valuable, especially for companies in industries where cash flow swings around a lot.

There’s also a timing element that actually works. Some companies are disciplined enough to buy back stock when it’s genuinely cheap. This can create real value. When you buy a dollar for fifty cents, you’ve made money. It’s just that most companies lack this discipline.

The best corporate capital allocators use buybacks like a scalpel, buying when the stock is undervalued and stopping when it isn’t. They treat their own stock like any other investment, buying it only when the price is right. This requires a level of rationality and long term thinking that’s surprisingly rare in corporate boardrooms.

The Hidden Third Option

Both dividends and buybacks assume the company has more cash than it can productively invest in its own business. This assumption is often wrong.

The best possible use of profits is usually to reinvest them in the business itself at high rates of return. If a company can deploy capital at twenty percent returns, why would it return that capital to shareholders who might only earn ten percent returns elsewhere? The math argues for keeping every dollar inside the business.

This is how you get companies like Amazon and Google that historically refused to pay dividends. They could always find something useful to do with the money. Even if some projects failed, the expected value of reinvestment beat the alternatives.

But here’s where it gets interesting. Most companies eventually mature. The great investment opportunities dry up. The market becomes saturated. Competition increases. Returns on new investments fall. At some point, hoarding cash becomes value destructive. The company needs to let go.

The question is whether management can recognize this moment. Many can’t. They keep pretending they’re a growth company long after growth has died. They make acquisitions that don’t make sense. They expand into businesses they don’t understand. They’d rather play with money than give it back.

This is where dividends and buybacks serve their real purpose. They force the cash out the door before management can do something stupid with it. The choice between dividends and buybacks is less important than the choice to return cash at all.

The Signaling Game

Both dividends and buybacks send messages to the market, but the messages are different and not always truthful.

A dividend increase signals confidence. It says the company expects to generate enough cash flow to support higher payouts indefinitely. Sometimes this signal is accurate. Sometimes it’s just management being optimistic or caving to shareholder pressure.

A buyback announcement signals that management believes the stock is undervalued. But this signal has become so corrupted that it barely means anything anymore. Companies announce buyback programs they never fully execute. They buy back stock at terrible prices. The announcement itself often boosts the stock price, which makes the subsequent buybacks less attractive. It’s a self defeating prophecy.

The only signal that really matters is the track record. Has management historically made smart capital allocation decisions? Do they buy back stock when it’s cheap and stop when it isn’t? Do they maintain dividends through difficult periods without damaging the business? Past behavior predicts future behavior better than any announcement or policy statement.

When Dividends Win

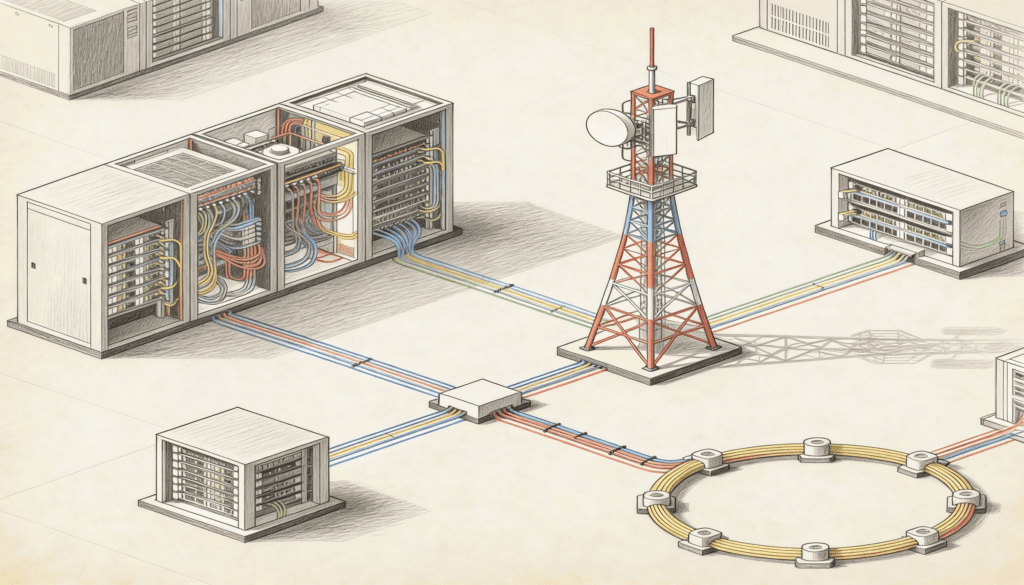

Certain situations favor dividends strongly. Mature businesses with stable cash flows should probably pay them. Utilities, consumer staples, telecom companies. These businesses aren’t going to suddenly triple in size. They generate steady income that exceeds what they can usefully reinvest. Fighting this reality by hoarding cash or making bad acquisitions is worse than just paying it out.

Dividends also work well when management has a history of poor capital allocation. If you can’t trust the executives to make good decisions, you want them to have as little discretionary capital as possible. Let them run the core business and nothing else. Take the cash and invest it yourself elsewhere.

There’s also the retiree argument, which isn’t really about math but about living your life. If receiving dividends makes you more comfortable spending money in retirement, then that comfort has real value. The point of accumulating wealth is to eventually use it. Whatever structure makes that psychologically easier is probably worth the small tax inefficiency.

When Buybacks Win

Buybacks make sense for companies whose stock is genuinely undervalued and whose management is disciplined enough to stop buying when the price rises. This is a rare combination, but it exists.

They also make sense for high growth companies where the stock price tends to move around a lot. Being flexible with capital returns is valuable when your business is evolving quickly. Locking into a dividend commitment would be premature.

And if you’re a taxable investor in a high tax bracket who plans to hold the stock for decades, the tax deferral advantage of buybacks is real. You avoid the dividend tax and hopefully pay only the lower capital gains rate far in the future. Compound this benefit over thirty years and it adds up.

The Berkshire Approach

Warren Buffett spent decades refusing to pay dividends at Berkshire Hathaway. His argument was simple: he could deploy that capital at better returns than shareholders could. For a long time, he was right. Berkshire’s per share value grew at extraordinary rates.

But even Buffett eventually started buying back Berkshire stock, though sparingly and only when he deemed the price attractive. He treats buybacks like an investment, not an obligation. Some years Berkshire buys back a lot of stock. Other years it buys back almost none. The flexibility is the point.

This approach only works because Buffett has earned trust through decades of good capital allocation. Most management teams haven’t earned that trust and won’t. For average companies with average management, returning cash regularly through dividends is probably the safer choice. It limits the damage that mediocre executives can do.

What Actually Matters

The dividend versus buyback debate misses the larger point. What really matters is the underlying business quality and the unit economics of what the company does. A great business with high returns on capital will create value almost regardless of how it returns excess cash to shareholders. A mediocre business will destroy value no matter how clever its capital return strategy seems.

Your focus should be on understanding what the company does, how it makes money, whether it has a competitive advantage, and whether management is trustworthy. The capital allocation question comes after you’ve answered these more fundamental questions.

If you find a wonderful business trading at a fair price run by honest and competent people, don’t get too worked up about whether they pay dividends or buy back stock. Either method can work fine. Just make sure they’re actually returning the cash somehow and not letting it pile up for no good reason.

The worst outcome is a company that neither reinvests profitably nor returns cash to shareholders. These businesses just accumulate money like sediment, slowly losing value in real terms while management talks about strategic flexibility and future opportunities that never quite materialize. That’s not capital allocation. That’s capital imprisonment.

Look for companies that know what they are. Mature businesses that accept their maturity and pay it out. Growth businesses that actually grow and reinvest wisely. And competent management that can tell the difference and act accordingly. Everything else is just details about how you’re getting your money back from a business that’s earning it.

The irony is that investors obsess over the mechanism of capital return while ignoring the more important question of whether there’s actually any capital worth returning. It’s like arguing about whether to receive your lottery winnings in installments or a lump sum before checking whether you actually won the lottery. First make sure the business is good. Then worry about how it gives you your share of the profits.