Table of Contents

Your brain doesn’t care about your retirement account. It cares about what happened in the last three seconds.

This fundamental mismatch explains why millions of rational, educated people with good jobs and solid futures find themselves refreshing their trading apps at 2 AM, watching a stock that represents 0.3% of their portfolio move by pennies. They’re not stupid. They’re not even particularly greedy. They’re just human beings running very old software in a very new environment.

Day trading feels like investing the way slot machines feel like strategic planning. Both involve money. Both involve decisions. But the similarity ends there. The distinction matters because your brain, that wrinkled lump of fatty tissue running the show, genuinely cannot tell the difference between the two. It wasn’t designed to.

The Casino in Your Pocket

Consider what happens in your brain when you check a stock price. Before you even see the number, your ventral tegmental area starts releasing dopamine in anticipation. Not because you made money. Not because you will make money. But because you might learn something new. Your brain treats information itself as a reward, especially uncertain information that could be good or bad.

This is the same neurological pathway that lights up when a gambler pulls a slot machine lever or when your dog hears the treat bag crinkle. It’s a prediction system, and prediction systems don’t care about outcomes measured in years. They care about outcomes measured in seconds.

The cruelty of modern trading platforms is that they understood this before you did. Every ping, every notification, every tiny green arrow pointing up is calibrated to activate this ancient circuit. The stock market has always existed, but for most of history it came with natural friction. You had to call a broker. Wait for confirmation. Pay significant fees. These inconveniences weren’t bugs in the system. They were features that protected you from yourself.

Now that friction is gone. You can buy and sell a stock while standing in line for coffee. Your brain interprets this ease as significance, as if the ability to do something quickly means you should do it constantly. This is like concluding that because you can check if your house is on fire every five minutes, you probably should.

The Illusion of Control

Here’s a strange truth about the human mind: we feel more in control when we’re frantically active than when we’re patiently passive, even when passivity is the superior strategy. A day trader making twenty decisions before lunch feels like a master of the universe. An index fund investor making zero decisions feels like they’re not even participating.

This sensation of control is almost entirely fictional. The day trader is reacting to randomness and pretending it’s pattern recognition. They’re the person in the passenger seat pressing an imaginary brake pedal. The movement feels meaningful because you’re moving, but the car doesn’t care about your foot.

Research consistently shows that the more you trade, the worse you perform. This isn’t a small effect. It’s dramatic. Active traders underperform passive investors by several percentage points annually, and the most active traders perform the worst. You could interpret this as evidence that trading is hard. The correct interpretation is that trading is fighting your own psychology while paying fees for the privilege.

But knowing this doesn’t help. Information rarely changes behavior when the behavior feels this good. A smoker who learns that cigarettes cause cancer doesn’t suddenly lose the nicotine receptors in their brain. A day trader who learns they’re likely to underperform doesn’t suddenly lose their dopamine response to watching numbers change colors.

The Narrative Trap

Humans are story-telling creatures. We can’t help ourselves. Show us any sequence of events and we’ll construct a narrative to explain it, even when no explanation exists. Especially when no explanation exists.

The stock market provides an endless supply of narratives. A stock goes up and financial media immediately explains why. Earnings were good. The sector is hot. Institutional investors are bullish. The next day the same stock goes down and different, equally confident explanations appear. Profit taking. Sector rotation. Macroeconomic concerns.

These stories feel like knowledge. They’re actually closer to sophisticated horoscopes. The narrative fallacy convinces you that because you can explain what happened yesterday, you can predict what will happen tomorrow. This is approximately as logical as believing that because you can explain why it rained last Tuesday, you can predict the weather three months from now.

Day traders become narrative addicts. Every price movement needs a story. Every story suggests an action. Every action generates a new price movement that needs a new story. It’s an infinite loop that feels like learning but is actually just pattern recognition software running on random noise.

The alternative, accepting that short term price movements are mostly random and unknowable, is psychologically intolerable. Randomness means powerlessness. Humans hate powerlessness more than they hate being wrong. Better to have an explanation that’s incorrect than no explanation at all.

The Social Proof Problem

Trading used to be a lonely activity. Now it’s a spectator sport with live commentary. Online communities share positions, strategies, and screenshots of gains. The winners are visible and vocal. The losers are silent and invisible. This creates a distorted information environment where success seems common and failure seems rare.

This is survival bias wearing a Reddit thread. For every person posting about turning $5,000 into $50,000, there are ninety-nine who turned $5,000 into $3,000 and stopped posting. But your brain doesn’t adjust for this. It sees evidence of success and concludes success is achievable. It sees people like you winning and thinks you can win too.

The painful irony is that the same intelligence that makes you good at your actual job makes you vulnerable here. Smart people are better at convincing themselves of things. They construct more elaborate justifications. They find more sophisticated reasons why this time will be different, why they’ve found an edge, why their analysis is superior.

Meanwhile, the person who buys an index fund and forgets about it for thirty years is deploying the actual intelligence. They’ve recognized that in a game where the house always wins, the winning move is not to play. Or rather, to play so boringly that it doesn’t feel like playing at all.

The Attention Economy Eats Returns

Every minute you spend thinking about your portfolio is a minute you’re not spending on something else. This opportunity cost is invisible on your brokerage statement but very real in your life. The mental energy consumed by constant monitoring could be directed toward your career, your relationships, your health, or literally anything else that compounds over time.

Day trading is expensive in ways that extend far beyond transaction fees. It colonizes your attention. It trains your brain to expect constant stimulation and immediate feedback. It makes the slow, boring work of actual wealth building feel inadequate by comparison. This is like optimizing your diet by eating seventeen small meals instead of three normal ones and calling it biohacking. You’re not more nourished. You’re just more distracted.

The most successful investors aren’t smarter than day traders. They’re more bored. They’ve accepted boredom as the price of returns. They’ve made peace with the fact that building wealth is supposed to feel like watching paint dry, not like playing video games.

The Dividend Alternative

Here’s what your brain actually responds to: tangible, regular, predictable rewards. This is why dividend investing has psychological advantages that have nothing to do with mathematical superiority. Getting a check every quarter feels like winning. It triggers the same reward circuits as trading, but it requires you to do exactly nothing.

Dividends are the methadone to trading’s heroin. Same receptors, less destructive activation pattern. You still get the pleasure of seeing money appear in your account. You still get to feel like you’re participating in markets. But you’re not churning your portfolio. You’re not fighting randomness. You’re just collecting payments for owning productive assets.

The math nerds will correctly point out that dividends are just a return of your own capital, that total return matters more than distribution method, that dividend strategies often underperform growth strategies. They’re right. But they’re also missing the point. Psychology isn’t about optimal. It’s about sustainable.

If dividend investing keeps you from panic selling during crashes or from churning your account into fee oblivion, it’s mathematically superior precisely because it’s psychologically sustainable. The best investment strategy isn’t the one with the highest theoretical return. It’s the one you’ll actually stick with.

The Paradox of Information

More information makes you less accurate but more confident. This is one of the most robust findings and one of the least intuitive. You’d think that more data would improve decisions. It doesn’t. It just improves your certainty that your decisions are correct.

Day traders are drowning in information. Real time prices. Technical indicators. News feeds. Analyst ratings. Earnings reports. Economic data. The information keeps coming and the brain keeps processing it into patterns that feel meaningful but predict nothing.

Professional poker players talk about going on tilt, that moment when emotion overrides strategy and you start making increasingly irrational bets to recover losses. Day trading is structural tilt. The environment itself induces the psychological state where rational analysis becomes impossible. You’re not occasionally going on tilt. You’re living there.

The solution isn’t better information. It’s less interaction with information. This feels wrong because we’ve been trained to believe that more knowledge equals better outcomes. Sometimes it does. But in environments dominated by randomness and noise, more knowledge just means more convincing stories about things that don’t matter.

The Retirement Account You’ll Actually Use

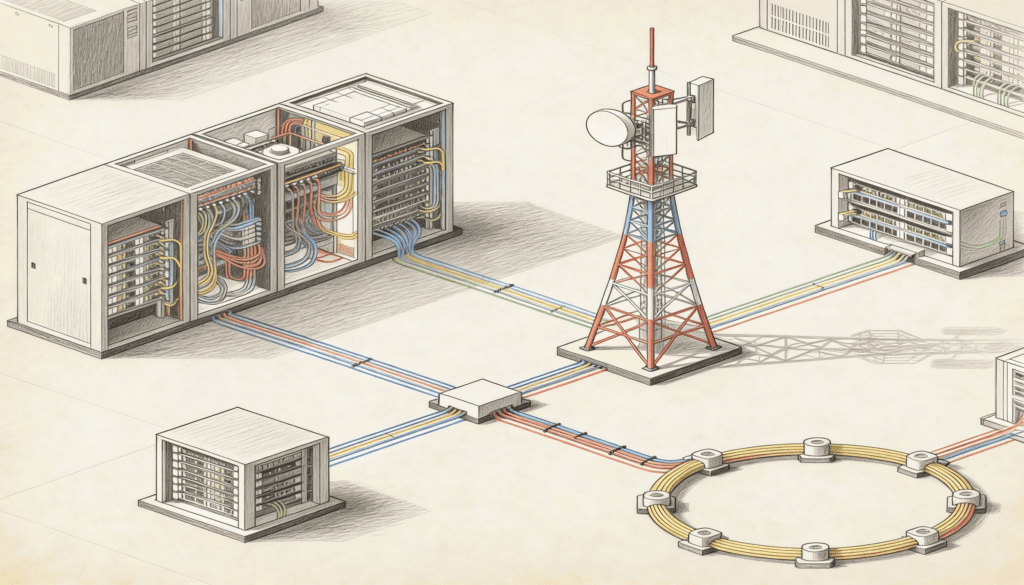

The reason employer retirement accounts work isn’t because of tax advantages or employer matching, though those help. It’s because they’re incredibly annoying to access. You can’t day trade your 401k. You can’t check it constantly. Most people forget it exists until the annual statement arrives. This neglect is the entire point.

The accounts that perform best are the ones their owners forgot they had. Dead people’s portfolios outperform living people’s portfolios. This isn’t a joke. The common factor is inactivity. Doing nothing beats doing something when something means constantly trading based on feelings masquerading as analysis.

Your brain is trying to help. When it screams at you to check that stock price, when it floods you with anxiety about missing out, when it makes you feel like you’re falling behind by not trading, it’s trying to keep you safe. It’s just working with obsolete threat detection software. The saber toothed tiger is gone but the fear response remains, now triggered by red numbers on a screen.

The Way Forward

Recognizing that you’re fighting neurology, not stupidity, is the first step. You’re not weak for wanting to check your portfolio constantly. You’re human. The platforms are designed by people who understand your neurology better than you do. They’ve built dopamine delivery systems and labeled them investment tools.

The actual solution is structural, not psychological. You can’t willpower your way out of brain chemistry. You can design an environment that protects you from your own impulses. Automatic investments. Accounts you can’t easily access. Asset allocations so boring that checking them feels pointless. These aren’t crutches. They’re acknowledgments of reality.

The market will be here tomorrow. And the day after that. And forty years from now when you actually need the money. The question isn’t whether you can beat it in the next hour. The question is whether you can avoid beating yourself over the next few decades.

Your dopamine system doesn’t care about that question. It cares about what’s happening right now, this second, this minute. Which is exactly why you can’t trust it with your financial future.

The smartest trade is the one you don’t make. The best portfolio decision is the one you forget you made. The optimal strategy is the one boring enough that you stop checking it and go live your actual life.

That’s not what your brain wants to hear. But unlike your brain, the truth doesn’t need to feel good to be correct.