Table of Contents

Every market generates its own folklore. Stories about indicators that supposedly crack the code, ratios that reveal hidden truths, formulas that turn chaos into clarity. Most of these stories are generous with promise and stingy with results. The put call ratio, though, is one of the few that actually delivers something worth paying attention to. Not because it predicts the future. But because it tells you something surprisingly honest about the present, and lets you draw your own conclusions about what comes next.

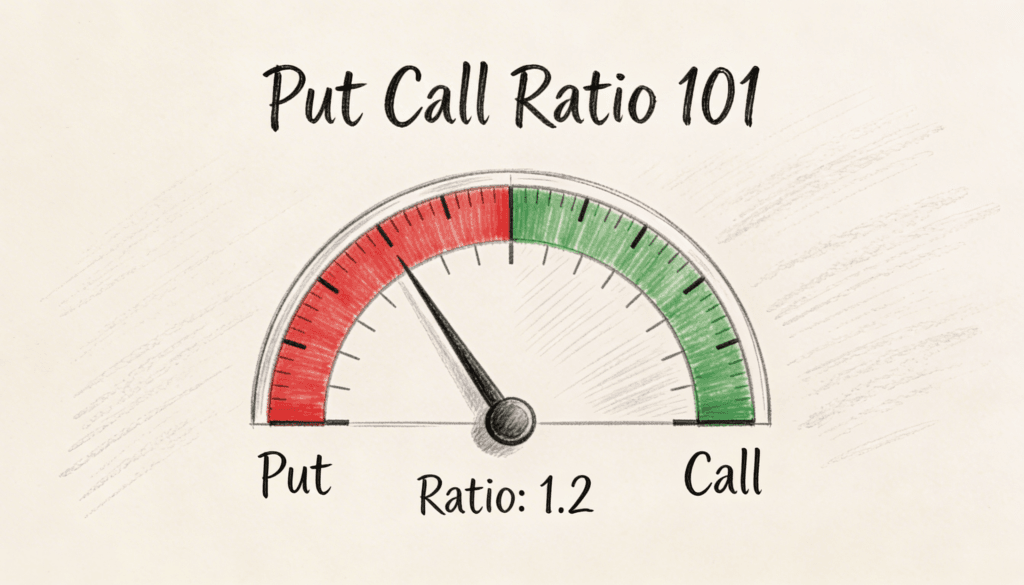

The concept is almost insultingly simple. Count how many put options traded today. Count how many call options traded. Divide the first number by the second. Puts are bearish instruments. Calls are bullish ones. When the ratio climbs, the options market is expressing anxiety. When it falls, confidence is expanding. That is the entire formula.

But simplicity in construction does not mean simplicity in use. The put call ratio is one of those tools that gets more complicated the longer you stare at it. And the complications are exactly where the value lives.

Reading the Room by Reading It Backwards

Most indicators work the way you would expect. Prices go up, the indicator says things are good. Prices go down, the indicator says things are bad. The put call ratio does not play by those rules.

When the ratio surges, it signals widespread fear. And widespread fear, it turns out, is often a precondition for a market bottom. When the ratio collapses, it signals widespread comfort. And widespread comfort tends to precede the moments when the market reminds everyone that comfort was never guaranteed.

This backward logic is what makes the ratio useful and what makes it so difficult to act on. It asks you to interpret extreme pessimism as a potential buying opportunity and extreme optimism as a warning sign. Your instincts will fight you every step of the way. The crowd is panicking, and the ratio is quietly suggesting you consider moving toward the fire rather than away from it.

The reason this works is not mystical. It is mechanical. When nearly every anxious participant has already bought their puts and hedged their portfolios, the selling energy is spent. There are very few people left to push prices lower. The pendulum has swung as far as it can in one direction. Gravity takes over from there.

Crowds, Contagion, and the Collapse of Independent Thought

The put call ratio belongs to a category of tools built on a single uncomfortable premise: when crowds reach consensus at the extremes, they tend to be wrong.

This does not mean crowds are always foolish. In ordinary conditions, aggregated opinion is remarkably accurate. Ask a hundred people to guess the weight of an object and the average of their guesses will often land close to the truth. But that accuracy depends on each person forming their opinion independently. The moment people start copying each other, the wisdom drains out and what remains is an echo chamber dressed up as consensus.

Options markets are especially vulnerable to this effect. Fear feeds on itself. When put volume rises, it pushes implied volatility higher. Higher volatility makes options more expensive. Expensive options make the market appear more dangerous. The appearance of danger triggers more put buying. The ratio climbs not because conditions are deteriorating in proportion but because a feedback loop has taken hold.

The put call ratio, at its extremes, is measuring the strength of that loop. And loops, by definition, cannot sustain themselves forever. They overshoot. They exhaust. They snap back. The ratio tells you when the rubber band has been stretched about as far as it can go.

The Invisible Divide Between Insurance and Panic

Here is something that rarely gets mentioned in the standard explainers. Not all put buying means the same thing. The ratio treats every put transaction equally, but the motivations behind those transactions could not be more different.

An institutional investor managing billions in equities buys index puts as a matter of routine. It is portfolio insurance. It says nothing about their outlook on the market. They might be profoundly bullish and still buy those puts because their mandate requires it.

Meanwhile, a retail trader who just watched a terrifying segment on financial television buys puts on individual stocks because they believe the world is ending. Same instrument. Same direction. Completely different information content.

This is why the options exchange publishes separate versions of the ratio. The equity put call ratio captures activity on individual stocks, which skews toward retail speculation. The index put call ratio captures activity on broad benchmarks, which skews toward institutional hedging. The combined ratio mixes both signals together, which is convenient but often muddy.

Knowing which version you are looking at changes the interpretation entirely. A spike in the equity ratio probably reflects genuine fear from smaller players. A spike in the index ratio might just mean a few large pension funds renewed their quarterly insurance policies. The raw number is the starting point of the analysis, not the conclusion.

The Art of Smoothing Out the Noise

Plot the daily put call ratio and you get something that resembles a seismograph during an earthquake. Wild swings, sharp reversals, readings that seem to contradict yesterday’s message entirely. This is because the daily number is influenced by everything from options expiration mechanics to single large block trades to algorithmic strategies that have zero directional intent.

Experienced practitioners solve this by applying a moving average. A short one, say five days, captures the immediate shift in mood. A longer one, perhaps twenty days, reveals whether sentiment is genuinely trending or just having a bad afternoon.

The smoothed ratio behaves differently from the raw daily figure. It moves more slowly. It gives fewer signals. But the signals it gives tend to be more reliable. You trade frequency for quality, which is almost always a good exchange in markets.

There is an analogy to how we absorb information in daily life. If you checked the news every fifteen minutes, your sense of the world would swing between catastrophe and salvation hourly. If you stepped back and assessed the general direction once a week, you would have a much more stable and accurate picture. The moving average is a deliberate act of stepping back. It sacrifices the illusion of being informed in real time for the reality of being informed in a useful way.

Where the Ratio Gets It Wrong

No tool works every time. The interesting question is not whether the put call ratio fails but how it fails, because the failure modes reveal something important about its limitations.

In grinding, sustained downtrends, the ratio can stay elevated for months. Fear remains high because the reasons for fear remain present. The contrarian signal keeps flashing green. And the market keeps falling. The ratio is technically correct that sentiment is bearish. It is just not correct that bearish sentiment means prices are about to reverse. Sometimes the crowd is scared because there is genuinely something to be scared of.

In long, steady bull markets, the mirror problem emerges. The ratio stays low. Everyone is positioned for more gains. The contrarian framework says caution. The market delivers another quarter of returns. Being right in theory and early in practice is financially indistinguishable from being wrong.

This teaches a crucial lesson. The put call ratio identifies conditions. It does not dictate timing. Extreme fear tells you a reversal is becoming more probable. It does not hand you a calendar date. Treating probability as prophecy is the most common and most costly mistake people make with sentiment tools.

Loss Aversion and the Emotional Algebra of Markets

The reason the put call ratio works at all has less to do with options math and more to do with how the human brain processes risk. Losing a thousand dollars does not feel like the mirror image of gaining a thousand dollars. It feels significantly worse.

When markets decline, this asymmetry kicks into overdrive. Investors do not respond proportionally to the threat. They overrespond. They buy more protection than the situation demands. They hedge more aggressively than the math justifies. This collective overreaction inflates put volume and drives the ratio higher than a purely rational market would produce.

And that inflation is exactly what creates the contrarian opportunity. If the ratio were a perfectly efficient reflection of actual risk, there would be no signal to exploit. The signal exists because human emotion distorts the reading. The ratio is not measuring risk. It is measuring the gap between actual risk and perceived risk. When that gap gets wide enough, prices have been pushed beyond what conditions warrant, and the snap back becomes likely.

There is something almost poetic about this. The very irrationality that makes markets stressful to participate in is the same irrationality that creates opportunities for those who can recognize it. The put call ratio is a window into that irrationality, a tool for measuring how far the emotional pendulum has swung from the factual center.

How Retail Trading Changed the Landscape

The put call ratio does not exist in a static world. The options market has transformed over the past several years, and those changes have altered how the ratio behaves and what it means.

The most significant shift has been the flood of retail participation driven by commission free trading platforms. Retail traders, broadly speaking, have a natural bias toward call buying. They are drawn to the upside. They like leverage. They enjoy the feeling of positioning for a big win. This structural tendency has depressed the baseline of the put call ratio over time. Average readings are lower than they used to be. What used to be neutral is now mildly bearish. Historical reference points need recalibration.

The second major change is the rise of ultra short dated options. Contracts that expire within a day now account for an enormous share of total options volume. These instruments create spectacular spikes and plunges in the daily ratio that are almost entirely disconnected from traditional directional sentiment. Someone trading a same day contract is usually making a volatility bet or a rapid speculation, not expressing a considered view on where the market will be next month.

This means the ratio requires more filtering today than it did in earlier eras. The raw data still contains information. But the proportion of noise to signal has increased. Anyone relying on the ratio without accounting for these structural changes is using a tool that has been quietly recalibrated without their knowledge.

Combining Signals to Build Something Stronger

The put call ratio works best as part of a conversation among indicators, not as a single oracle delivering verdicts.

When the ratio says fear is elevated, the next question should be whether other tools agree or disagree. If credit spreads are widening, if market breadth is deteriorating, if volatility measures are confirming stress across multiple asset classes, then the fear is probably reflecting something real. The contrarian bet becomes riskier.

But when the ratio says fear is elevated and prices have stopped falling, breadth is stabilizing, and volatility is beginning to contract, you have a divergence. The emotion says one thing. The market structure says another. That disagreement is where the most powerful trading signals emerge.

Think of it the way a detective thinks about witness testimony. One witness telling a story is interesting. Five witnesses telling the same story is convincing. But one witness saying something different from the other four is the most interesting clue of all. The put call ratio is one witness. Its testimony matters most when it conflicts with the others.

The Discipline of Doing Nothing

One of the hardest truths about the put call ratio is that it spends most of its time saying absolutely nothing useful. The extreme readings that generate genuine contrarian signals are, by their nature, infrequent. A ratio sitting in its normal range is the equivalent of a traffic light stuck on yellow. Proceed with caution. Or do not proceed at all.

For people who want constant engagement with markets, this is maddening. There is always a temptation to treat moderate readings as significant. To convince yourself that the ratio is close enough to an extreme to justify a position. It almost never is. The put call ratio rewards the patient and punishes the restless.

This connects to a broader principle that applies well beyond trading. The quality of your outcomes often depends less on what you do than on what you resist doing. Every mediocre trade you decline to take preserves capital and clarity for the trade that actually matters. The put call ratio, for long stretches, is essentially an exercise in strategic inaction. It sits there, registering unremarkable numbers, testing whether you have the discipline to wait.

The Larger Frame

Zoom out far enough and the put call ratio becomes something more than a trading tool. It becomes a small illustration of a much larger idea. Groups of people, acting on emotion, tend to overshoot in both directions. They become too fearful when things look bad and too confident when things look good. This pattern is visible in markets, in politics, in culture, in technology adoption, in almost any domain where collective human behavior shapes outcomes.

The put call ratio just gives that pattern a number. It takes the ancient cycle of fear and greed and renders it measurable. And by making it measurable, it makes it, at least partially, actionable.

But only partially. The ratio cannot eliminate the uncertainty that sits at the heart of every market decision. It cannot tell you whether this particular spike in fear is the one that marks the bottom or the one that precedes a further leg down. It speaks in probabilities, not promises.

In a world that worships certainty and algorithmic precision, there is something valuable about an indicator that works best when interpreted through human judgment, patience, and a willingness to disagree with everyone else in the room. The ratio does not reward cleverness. It rewards temperament. And temperament, in markets and in life, is almost always the more durable edge.