Table of Contents

Many investors are playing the wrong game. They obsess over returns like kids comparing Halloween candy hauls, bragging about how much they got while conveniently forgetting to mention the stomach aches. The financial industry encourages this myopia because it sells products. Beat the market. Alpha generation. Outperformance. These phrases populate marketing materials like confetti at a parade, and investors eat them up.

But here’s the uncomfortable truth: a 30% annual return means absolutely nothing if you can’t sleep at night. And more to the point, that 30% return means nothing if it came with enough volatility to age you a decade in a year.

Enter the Sharpe ratio, a metric so elegant it borders on beautiful. It doesn’t care about your returns in isolation. It cares about your returns relative to the punishment you endured to achieve them. Risk adjusted returns. It’s the difference between judging a mountain climber by altitude gained versus altitude gained per unit of danger faced. One celebrates recklessness. The other celebrates mastery.

The Illusion of Skill

Most investment performance is noise masquerading as signal. Someone makes 50% in a year and suddenly they’re the next Warren Buffett, fielding calls from relatives who previously thought them unemployable. But that 50% probably came from being heavily weighted in exactly the sector that happened to explode that year. Tech, crypto, meme stocks, whatever the roulette wheel landed on. The following year, that same genius is down 40% and wondering if maybe index funds weren’t such a boring idea after all.

The Sharpe ratio cuts through this delusion. It asks: did you earn those returns because you’re genuinely skilled, or because you took obscene risks that happened to pay off this time? The metric distinguishes between the poker player with a system and the drunk guy who bet his mortgage on a pair of threes and got lucky.

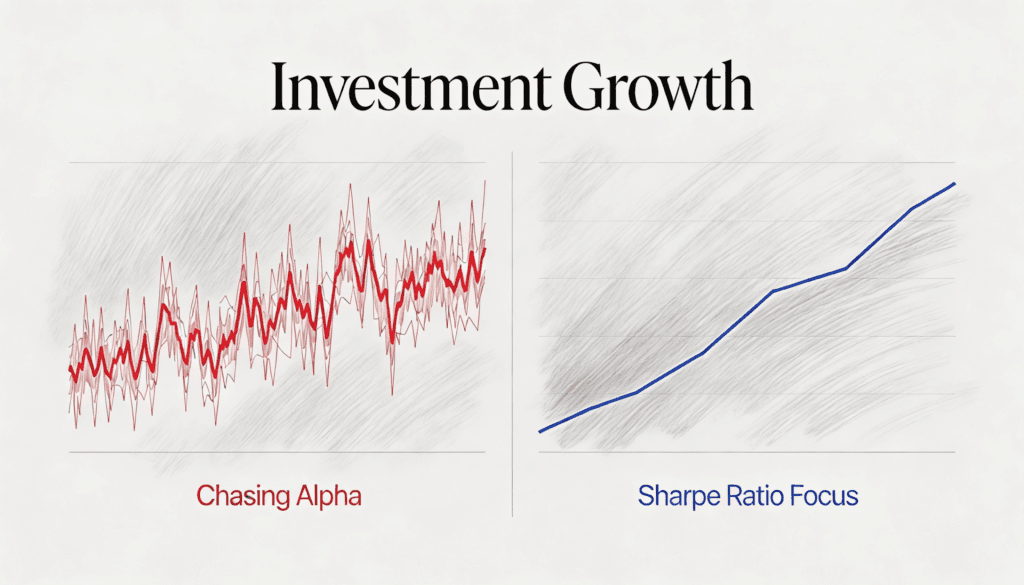

Consider two portfolios. Portfolio A returns 25% annually with 30% volatility. Portfolio B returns 12% annually with 8% volatility. Every amateur investor picks A. Look at those returns! But the Sharpe ratio reveals that B is actually the superior portfolio. It delivers a smoother ride, preserves your sanity, and most importantly, compounds more reliably over time.

This is where most people’s intuition fails them. Volatility isn’t just unpleasant. It’s mathematically destructive. If your portfolio drops 50%, you need a 100% return just to break even. This asymmetry means that avoiding large drawdowns matters more than capturing large upswings. The Sharpe ratio understands this. It penalizes volatility not out of squeamishness but out of mathematical necessity.

Why We Can’t Help Ourselves

Humans are terrible at evaluating risk adjusted returns naturally. We evolved to spot saber toothed tigers, not optimize portfolio construction. Our brains are wired to remember the wins and downplay the near misses. We feel the pain of losses about twice as intensely as we feel the pleasure of gains, yet somehow we still act like degenerate gamblers when shown a chart sloping upward and to the right.

There’s a reason casinos work. They exploit the same cognitive biases that make investors chase alpha. You remember the time you hit blackjack. You forget the twenty hands before it where you slowly bled chips. In investing, you remember the stock that tripled. You don’t properly account for the eight stocks that went nowhere or the two that halved.

The Sharpe ratio is the antidote to our psychological weaknesses. It forces objectivity into a domain where emotion usually reigns supreme. It’s the friend who tells you that no, you weren’t actually amazing at poker last night, you just got lucky cards. Nobody likes that friend initially, but that friend is right.

The Compounding Trap

Alpha chasers often misunderstand compounding. They think more returns equals more compounding. But compounding isn’t just about the size of returns. It’s about consistency. A portfolio that returns 15% every single year for a decade destroys a portfolio that alternates between 40% and negative 10%, even though the arithmetic average return is identical.

This is why the Sharpe ratio matters so profoundly. It captures something essential about how money actually grows over time in the real world rather than in Excel spreadsheets. Smooth, consistent returns compound beautifully. Jagged, volatile returns compound poorly, eaten away by the mathematics of recovery.

Think of it like a car trip. You can average 60 miles per hour two different ways. You can drive steadily at 60 the whole time, or you can alternate between 100 and 20. The average speed is the same. But in the second scenario, you’re going to attract police attention, endanger yourself, stress out your passengers, and probably arrive later because you had to slow down so dramatically to compensate for the speeding.

Investment returns work the same way. The journey matters, not just the destination. And yet the financial industry almost exclusively markets based on destination. Look where we got people! they shout. They conveniently omit the part where half the passengers jumped out in terror along the way.

The Social Dimension

There’s a social element here too that rarely gets discussed. When you tell someone at a dinner party that your portfolio returned 40% last year, you get admiration. When you tell them your Sharpe ratio is 1.8, you get confused stares. This social feedback loop encourages terrible behavior.

We are social creatures. We care about status. And investment returns have become a form of status signaling, especially in certain circles. This turns investing into a competition, which is precisely the wrong frame. You’re not competing against other investors. You’re competing against your own financial goals, your own risk tolerance, your own ability to stay rational under pressure.

The Sharpe ratio reframes the conversation. It shifts the focus from comparison to sustainability. A truly good investor isn’t the one who made the most money last year. It’s the one who can keep making good money for decades without blowing up. That’s a much less sexy story to tell at parties, but it’s the only story that matters for actual financial security.

The Paradox of Safety

Here’s something counterintuitive: focusing on the Sharpe ratio often leads to higher absolute returns over long periods, even though that’s not the goal. How? Because investors who prioritize risk adjusted returns stay in the game. They don’t panic sell at bottoms. They don’t blow up their accounts. They remain psychologically capable of maintaining rational positions.

Meanwhile, the alpha chasers flame out. They have one or two spectacular years, then they overextend, the market turns, and they’re wiped out. Or worse, they’re not quite wiped out but they’re so damaged psychologically that they sell everything and hide in cash for years, missing the recovery.

This is the dark irony of return chasing. In trying to maximize returns, you often minimize them. The guy swinging for the fences strikes out. The guy playing for consistent base hits ends up scoring more runs over the season.

Investment success is as much about survival as optimization. Actually, it’s more about survival. You can have a mediocre strategy and succeed through decades of discipline. You cannot have a spectacular strategy and succeed if you psychologically or financially blow up before it pays off. The Sharpe ratio acknowledges this reality. Pure return metrics ignore it.

The Philosophical Shift

Adopting the Sharpe ratio as your north star requires a philosophical transformation. You have to stop thinking of investing as a competitive sport and start thinking of it as risk management. You’re not trying to beat anyone. You’re trying to build wealth steadily, preserve capital during disasters, and compound your way to financial independence.

This shift feels like a loss at first. There’s something thrilling about chasing big returns, checking your portfolio every hour, feeling like a master of the universe when you’re up and a tragic figure when you’re down. It’s engaging in the way that gambling is engaging. The Sharpe ratio approach feels boring by comparison.

But boring is the point. Boring is beautiful. Boring means you’re focused on the right things. It means you’re building a portfolio you can hold through thick and thin. It means you’re playing a game you can actually win rather than one designed to transfer your money to Wall Street.

The best investors in history understood this intuitively. They didn’t chase alpha. They built durable competitive advantages, managed risk obsessively, and let time do the heavy lifting. Buffett’s genius isn’t that he finds stocks that go up a lot. It’s that he finds businesses that don’t go down much, then holds them forever. His edge is stability, not volatility.

Beyond Finance

The logic of the Sharpe ratio extends beyond investing. Any time you’re evaluating a strategy based on outcomes, you should consider the risk taken to achieve those outcomes. A business strategy that delivers 30% growth but threatens bankruptcy if one thing goes wrong is probably worse than a strategy delivering 15% growth with robust margins of safety.

A career that pays extremely well but requires 80 hour weeks and destroys your health is probably worse than a career that pays well enough while preserving your wellbeing. A relationship that provides intense highs and lows is probably worse than one that provides steady contentment. The math of risk adjusted returns applies to nearly every important decision.

We live in a culture that glorifies extremes. The entrepreneur who mortgages everything and succeeds becomes a hero. The nineteen who try the same thing and fail become statistics we ignore. This survivorship bias corrupts our thinking across domains. We see the lottery winners and assume the lottery is a good bet.

The Sharpe ratio mentality is the antidote. It forces you to think probabilistically. It demands that you consider not just what happens when things go right but what happens when they go wrong. It insists on margin of safety. These principles are universally applicable and universally ignored.

The Only Metric

So why is the Sharpe ratio the only metric that matters? Because it’s the only metric that honestly captures what investing is actually about. Investing is not about getting rich quick. It’s not about beating your neighbor. It’s not about feeling smart. It’s about exchanging consumption today for security tomorrow while taking reasonable risks.

The Sharpe ratio is the mathematical formalization of wisdom. It says: of course you want returns, everyone wants returns, but you need to earn those returns sustainably. You need to build a portfolio that can survive your own psychology, survive market crashes, survive inflation, survive recessions, and keep compounding through it all.

Everything else is marketing. Everything else is either a subset of the Sharpe ratio or a distraction from it. Returns without risk adjustment are meaningless. Alpha that disappears during drawdowns is worthless. Outperformance that causes you to sell at bottoms is self defeating.

The beauty of focusing on the Sharpe ratio is that it simplifies everything. You don’t need to predict the market. You don’t need to find the next Amazon. You don’t need to time trades or chase trends. You need to build a diversified portfolio appropriate to your risk tolerance, rebalance periodically, and ignore the noise.

This is achievable. This is sustainable. This is what works. And paradoxically, this is what almost nobody does, because it’s not exciting enough. The financial industry can’t sell you this message because there’s nothing to sell. A simple portfolio of low cost index funds rebalanced annually will give most people an excellent Sharpe ratio and make them financially secure.

But there’s no commission in that advice. There’s no management fee. There’s no exciting story. Just the quiet compounding of wealth over decades, which is apparently too boring for most people to stomach. Their loss. Literally.

The case for stopping the chase of alpha isn’t a case for giving up. It’s a case for growing up. It’s recognizing that investing is a long game where survival and consistency matter infinitely more than spectacular short term wins. The Sharpe ratio isn’t just a better metric. It’s the only metric that actually measures what matters.